Imagine getting pulled over for a traffic violation, only to discover that your driving privileges are in jeopardy. This is where SR-22 insurance enters the picture. Often associated with high-risk drivers, SR-22 insurance is a specialized form of financial responsibility that can feel like a bureaucratic hurdle. But understanding its purpose, requirements, and implications can help you navigate the complexities of maintaining your driving rights.

SR-22 insurance, also known as a “certificate of financial responsibility,” is a crucial element in demonstrating your ability to cover potential damages resulting from accidents. It serves as proof to state authorities that you have met the minimum financial requirements for driving. While it might seem like an additional burden, SR-22 insurance is a necessary step in regaining your driving privileges and protecting yourself from legal and financial consequences.

SR-22 Insurance Definition

SR-22 insurance is a form of financial responsibility proof required by certain states for drivers with a history of driving violations. This type of insurance acts as a guarantee that the driver will be able to pay for any damages or injuries they cause in an accident.

Purpose of SR-22 Insurance

SR-22 insurance serves as a safeguard for the public, ensuring that drivers who have committed driving offenses are financially responsible for any future accidents they may cause. It is a crucial tool for state governments to hold drivers accountable and protect innocent parties from financial hardship resulting from reckless driving.

Situations Requiring SR-22 Insurance

States mandate SR-22 insurance for drivers who have been convicted of specific driving offenses, including:

- Driving under the influence (DUI) or driving while intoxicated (DWI)

- Driving with a suspended or revoked license

- Multiple traffic violations, such as speeding tickets or reckless driving

- Hit-and-run accidents

- Failing to provide proof of insurance

The specific offenses and requirements for SR-22 insurance vary from state to state.

What is SR-22 Insurance?

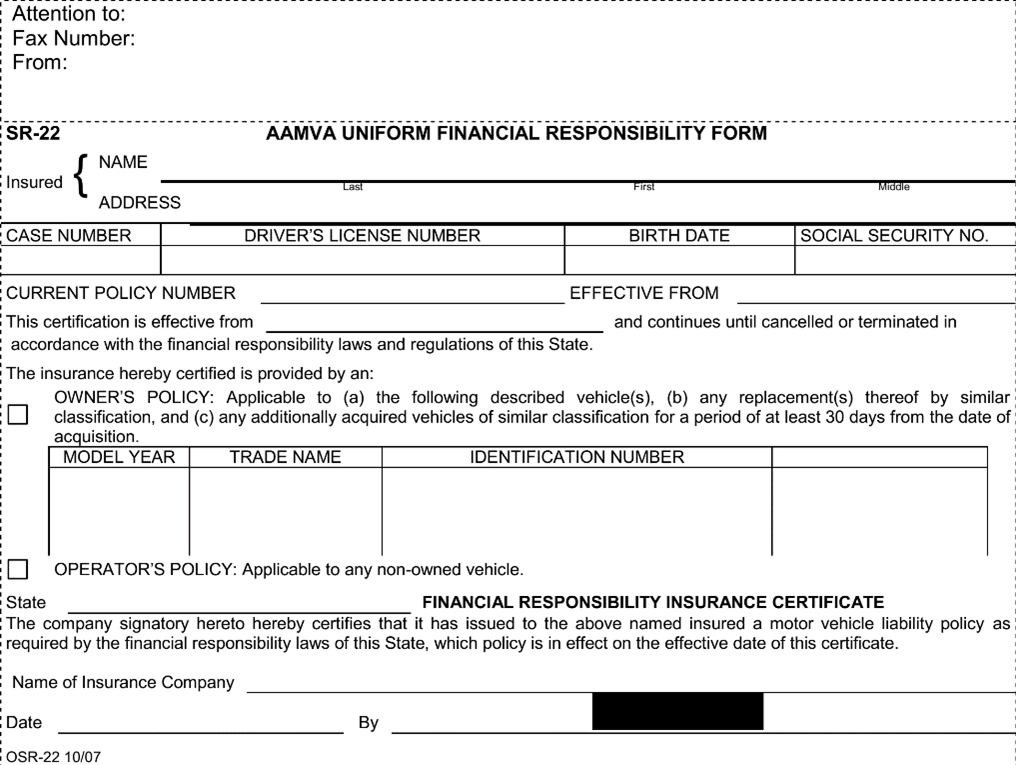

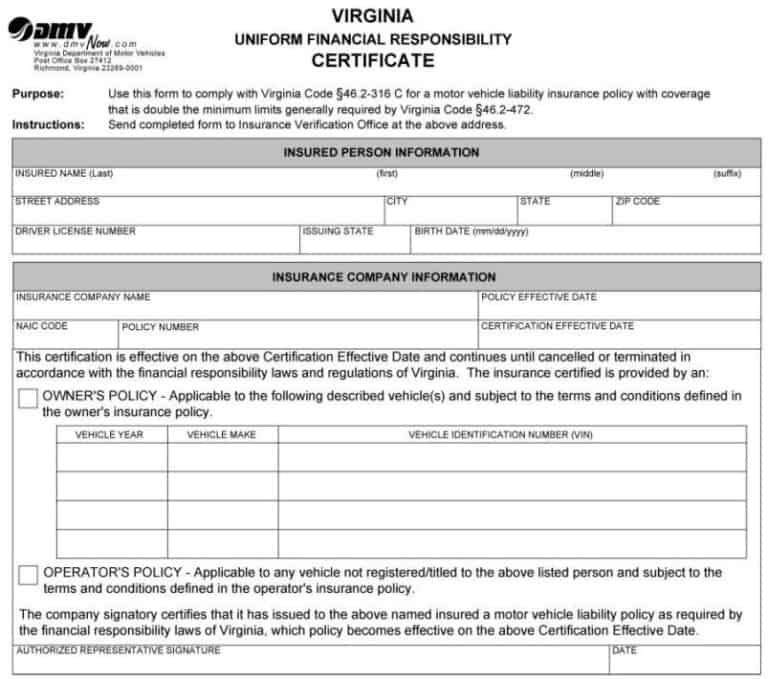

SR-22 insurance is not a separate insurance policy; rather, it is a form or certificate filed with the state by the driver’s insurance company. This certificate confirms that the driver maintains the minimum liability insurance coverage required by the state. The insurance company files the SR-22 on the driver’s behalf, ensuring that the state has proof of their financial responsibility.

Filing an SR-22

When a driver is required to file an SR-22, their insurance company will file the certificate with the state’s Department of Motor Vehicles (DMV) or a similar agency. The certificate typically remains in effect for a specific period, usually one to three years, depending on the state and the severity of the driving offense.

Who Needs SR-22 Insurance

SR-22 insurance is a specific type of insurance required by state governments in certain situations. It acts as proof of financial responsibility for drivers who have been convicted of certain driving offenses or who have a history of high-risk driving behavior.

Individuals Required to Carry SR-22 Insurance

SR-22 insurance is mandated for drivers who have demonstrated a higher-than-average risk of causing accidents or violating traffic laws. These individuals typically fall into one of the following categories:

- Drivers with DUI/DWI Convictions: Drivers convicted of driving under the influence (DUI) or driving while intoxicated (DWI) are often required to carry SR-22 insurance for a specified period. This is because their driving history suggests a higher likelihood of future traffic violations.

- Drivers with Multiple Traffic Violations: Individuals with a pattern of traffic violations, such as speeding tickets, reckless driving citations, or multiple accidents, may be required to carry SR-22 insurance. These individuals are considered higher-risk drivers, and the SR-22 ensures they have sufficient financial coverage to cover potential damages caused by future accidents.

- Drivers with Suspended Licenses: Drivers who have had their licenses suspended due to traffic violations or unpaid fines often need to obtain SR-22 insurance to reinstate their driving privileges. This requirement helps ensure that drivers are financially responsible before they are allowed back on the road.

- Drivers with No Insurance or Lapsed Coverage: In some states, drivers who have been caught driving without insurance or whose insurance has lapsed may be required to carry SR-22 insurance for a certain period. This requirement helps to deter drivers from driving without proper coverage and ensures that they have financial responsibility in case of accidents.

Reasons for SR-22 Insurance

The primary purpose of SR-22 insurance is to ensure that drivers who have demonstrated a higher risk of causing accidents have adequate financial coverage to cover potential damages. This is achieved through the following mechanisms:

- Financial Responsibility: SR-22 insurance serves as proof of financial responsibility. It guarantees that the driver has sufficient financial resources to cover damages and injuries caused by accidents.

- Deterring Future Violations: The requirement of SR-22 insurance acts as a deterrent for drivers with a history of traffic violations. It encourages them to drive more responsibly and avoid future violations.

- Protecting the Public: By ensuring that high-risk drivers have adequate financial coverage, SR-22 insurance protects the public from potential financial losses caused by accidents involving these drivers.

Examples of Situations Requiring SR-22 Insurance

| Reason for SR-22 | Examples of Situations |

|—|—|

| DUI/DWI Conviction | – First-time DUI conviction

– Second or subsequent DUI conviction |

| Multiple Traffic Violations | – Three or more speeding tickets within a year

– Reckless driving citation

– Multiple accidents within a short period |

| Suspended License | – Failure to pay traffic fines

– Driving with a suspended license

– Driving without insurance |

| No Insurance or Lapsed Coverage | – Driving without insurance

– Allowing insurance to lapse |

How SR-22 Insurance Works

SR-22 insurance is a form of financial responsibility proof that demonstrates your ability to pay for damages or injuries caused by a car accident. It’s a requirement imposed by state motor vehicle departments for drivers who have committed certain driving offenses. This insurance acts as a guarantee that you’ll be able to cover any financial obligations arising from an accident.

Obtaining SR-22 Insurance

To obtain SR-22 insurance, you’ll need to contact an insurance company and request a policy that includes an SR-22 filing. The process involves the following steps:

- Contact an insurance company: You can either contact your current insurance provider or shop around for a new one.

- Provide necessary information: The insurance company will require personal information, driving history, and details about your vehicle.

- File the SR-22 form: The insurance company will file the SR-22 form with your state’s motor vehicle department on your behalf. This form acts as proof of your financial responsibility.

- Pay the premium: You’ll need to pay the premium for the SR-22 insurance policy, which may be higher than standard car insurance due to your driving record.

Differences Between SR-22 Insurance and Standard Car Insurance

SR-22 insurance is not a separate type of insurance; it’s an addendum to your standard car insurance policy. Here’s how it differs from regular car insurance:

- Filing requirement: SR-22 insurance is required by the state for specific driving offenses, while standard car insurance is a general requirement for vehicle ownership.

- Higher premiums: SR-22 insurance premiums are generally higher than standard car insurance premiums because of the increased risk associated with drivers who have committed driving offenses.

- Duration: The duration of SR-22 insurance is determined by your state’s regulations and the specific offense you committed. It typically lasts for a period of one to three years.

Duration of SR-22 Insurance

The duration for which you’ll need SR-22 insurance depends on the specific offense you committed and your state’s regulations. For instance, in some states, you may need to maintain SR-22 insurance for three years if you’ve been convicted of a DUI, while a speeding ticket might only require it for a year. It’s crucial to check with your state’s motor vehicle department to determine the specific requirements for your situation.

Cost of SR-22 Insurance

SR-22 insurance, while a necessary evil for some, can significantly impact your insurance premiums. Understanding the factors that influence the cost of this type of insurance is crucial for budgeting and navigating the complexities of the insurance market.

Factors Influencing the Cost of SR-22 Insurance

The cost of SR-22 insurance is heavily influenced by a range of factors, including your driving history, the type of vehicle you drive, your location, and the insurance company you choose.

- Driving History: A clean driving record is paramount. Your past driving violations, including DUI convictions, accidents, and traffic tickets, directly impact your SR-22 insurance premiums. The more serious the offense, the higher the premium.

- Vehicle Type: The type of vehicle you drive plays a role in your SR-22 insurance cost. Sports cars, luxury vehicles, and high-performance vehicles are typically more expensive to insure due to their higher repair costs and potential for greater risk.

- Location: Where you live matters. Insurance companies consider factors like the density of traffic, crime rates, and the likelihood of accidents in your area when determining premiums. Urban areas often have higher insurance rates than rural areas.

- Insurance Company: Different insurance companies have varying rates and policies. It’s essential to compare quotes from multiple insurers to find the best rate for your specific needs.

Cost Comparison with Standard Car Insurance

SR-22 insurance is generally more expensive than standard car insurance. This is because it’s considered a higher-risk policy due to the driver’s history of violations. The cost difference can vary significantly, ranging from a few hundred dollars to several thousand dollars per year, depending on the factors mentioned above.

Examples of Cost Variations

Here are some examples of potential cost variations based on different factors:

- Driver with a DUI conviction: A driver with a DUI conviction could face an SR-22 insurance premium that’s 2-3 times higher than a driver with a clean driving record.

- Driver with multiple traffic violations: A driver with multiple traffic violations, such as speeding tickets and reckless driving citations, could see their SR-22 insurance premiums increase by 50% or more compared to a driver with fewer violations.

- Driver living in a high-risk area: A driver living in a high-risk area, such as a city with a high crime rate, could face an SR-22 insurance premium that’s 10-20% higher than a driver living in a low-risk area.

SR-22 Insurance and Driving Privileges

SR-22 insurance is not a type of insurance policy but rather a form filed with the state’s Department of Motor Vehicles (DMV) to prove you have the minimum required liability insurance coverage. It serves as a financial responsibility filing, ensuring that you can pay for damages or injuries caused by a traffic accident. While SR-22 insurance is mandatory for certain drivers, it also has a direct impact on their driving privileges.

Consequences of Not Maintaining SR-22 Insurance

Failing to maintain SR-22 insurance can lead to serious consequences. It is crucial to understand the potential repercussions of not meeting this requirement.

- License Suspension: Your driver’s license will be suspended if you fail to maintain the required SR-22 insurance. This means you will be prohibited from driving legally.

- Fines and Penalties: You may face fines and penalties for not maintaining SR-22 insurance. These fines can vary depending on the state and the severity of the violation.

- Difficulty Obtaining Insurance: Future insurance providers may find it difficult to offer you coverage if you have a history of not maintaining SR-22 insurance. This can make it challenging to obtain affordable insurance in the future.

Process of Getting SR-22 Insurance Removed

Getting SR-22 insurance removed involves a specific process that varies by state. Typically, it requires a clean driving record for a specified period.

- Meet State Requirements: Each state has its own requirements for removing SR-22 insurance. These requirements may include a specific duration of time without traffic violations or accidents.

- File a Request with the DMV: Once you meet the state requirements, you need to file a request with the DMV to have the SR-22 insurance removed. This typically involves providing proof of a clean driving record.

- Confirmation from Insurance Provider: Your insurance provider will also need to confirm that you have maintained the required coverage for the specified period.

Finding SR-22 Insurance

Securing SR-22 insurance is crucial for those who have had their driving privileges revoked or suspended. This specialized insurance policy demonstrates to state authorities that you are financially responsible and have met the requirements for reinstating your license. While finding SR-22 insurance might seem daunting, understanding the process and following a structured approach can make it easier.

Finding SR-22 Insurance Providers

Obtaining SR-22 insurance requires working with an insurance provider that offers this specific type of coverage. While not all insurance companies offer SR-22 insurance, many do, and finding one that meets your needs is crucial. Start by contacting your current insurance provider and inquire about their SR-22 insurance offerings. If they don’t offer this type of coverage, you can explore other options.

- Online Insurance Marketplaces: Websites like Insurance.com, The Zebra, and Policygenius allow you to compare quotes from multiple insurance providers, making it easier to find the best rates for SR-22 insurance.

- Independent Insurance Agents: Independent insurance agents work with a network of insurance companies and can help you find SR-22 insurance options that best suit your situation.

- State Department of Motor Vehicles: Your state’s Department of Motor Vehicles website often lists insurance companies that offer SR-22 insurance within your region.

Comparing Quotes from Multiple Providers

Once you’ve identified a few potential SR-22 insurance providers, it’s essential to compare quotes to ensure you’re getting the best possible rates.

- Factors to Consider: When comparing quotes, consider the following factors:

- Premium Cost: SR-22 insurance is typically more expensive than standard car insurance due to the higher risk associated with drivers who have had their licenses revoked or suspended. Compare premium costs across different providers to find the most affordable option.

- Coverage Options: Make sure the insurance company offers the coverage you need, such as liability, collision, and comprehensive coverage.

- Customer Service: Look for a company with a good reputation for customer service and responsiveness.

- Online Tools: Online insurance comparison websites and independent insurance agents can help you quickly compare quotes from multiple providers.

- Negotiating Rates: Once you’ve found a provider that offers competitive rates, consider negotiating your premium. You may be able to lower your costs by improving your driving record, increasing your deductible, or bundling your insurance policies.

Step-by-Step Guide for Obtaining SR-22 Insurance

Finding SR-22 insurance requires a methodical approach. Here’s a step-by-step guide to help you navigate the process:

- Contact Your Current Insurance Provider: Start by contacting your current insurance provider to inquire about their SR-22 insurance offerings.

- Explore Other Providers: If your current provider doesn’t offer SR-22 insurance, research other insurance companies through online marketplaces, independent insurance agents, or your state’s Department of Motor Vehicles website.

- Compare Quotes: Gather quotes from multiple insurance providers, focusing on premium costs, coverage options, and customer service.

- Negotiate Rates: Once you’ve found a provider with competitive rates, consider negotiating your premium.

- Complete the Application: Once you’ve chosen a provider, complete the application process, providing all necessary documentation, including your driving record and proof of identity.

- Pay Your Premium: Pay your first premium to activate your SR-22 insurance policy.

- Receive Your SR-22 Certificate: The insurance company will electronically file the SR-22 certificate with your state’s Department of Motor Vehicles.

- Maintain Your Policy: Continue to pay your premiums and maintain your policy for the duration of your SR-22 requirement.

SR-22 Insurance and Driving Records

SR-22 insurance is inextricably linked to a driver’s history behind the wheel. It acts as a guarantee to the state that a driver will maintain financial responsibility, particularly after a serious driving offense. This connection is vital to understanding the purpose and implications of SR-22 insurance.

The Role of the DMV in SR-22 Insurance

The Department of Motor Vehicles (DMV) plays a central role in managing SR-22 insurance. It’s the DMV that typically mandates the requirement for SR-22 insurance after certain driving violations. The DMV receives proof of insurance from the insurance company, ensuring the driver maintains coverage as required.

Driving Record Violations and SR-22 Requirements

Driving record violations can significantly impact SR-22 insurance requirements. Here are some examples:

- Driving Under the Influence (DUI/DWI): A DUI conviction often triggers an SR-22 requirement, typically lasting for a specified period, such as three to five years. This requirement is enforced to demonstrate financial responsibility for any future accidents caused by the driver.

- Reckless Driving: Reckless driving convictions can also lead to SR-22 insurance requirements, demonstrating the state’s concern about the driver’s potential risk to others on the road.

- Multiple Traffic Violations: Even without a serious offense, accumulating multiple traffic violations, such as speeding tickets or failure to yield, can lead to an SR-22 requirement. This indicates a pattern of unsafe driving behavior that requires additional monitoring.

SR-22 Insurance and Financial Responsibility

SR-22 insurance is directly linked to state financial responsibility laws, which are designed to protect the public from financially irresponsible drivers. These laws require drivers to demonstrate their ability to cover the costs of any accidents they cause, ensuring that victims are compensated for damages.

Financial Responsibility Laws and SR-22 Insurance

Financial responsibility laws vary from state to state, but they generally require drivers to provide proof of financial responsibility, often in the form of insurance coverage, to meet specific minimum liability limits. These limits typically cover bodily injury liability, property damage liability, and uninsured/underinsured motorist coverage. When a driver is found to be at fault in an accident, they are required to meet these financial responsibility requirements to maintain their driving privileges.

How SR-22 Insurance Ensures Financial Responsibility

SR-22 insurance acts as a certificate of financial responsibility, providing proof to the state that a driver meets the minimum liability requirements. When a driver is required to file an SR-22, their insurance company files a form with the state’s Department of Motor Vehicles (DMV), indicating that they have the necessary coverage. The SR-22 remains in effect for a specified period, usually for several years, and ensures that the driver maintains the required insurance coverage throughout that time.

State Financial Responsibility Requirements

The specific financial responsibility requirements vary significantly across states. Here is a table comparing the minimum liability limits in a few states:

| State | Bodily Injury Liability (per person) | Bodily Injury Liability (per accident) | Property Damage Liability |

|—|—|—|—|

| California | $15,000 | $30,000 | $5,000 |

| Florida | $10,000 | $20,000 | $10,000 |

| New York | $25,000 | $50,000 | $10,000 |

| Texas | $30,000 | $60,000 | $25,000 |

It is important to note that these are just a few examples, and the actual requirements may vary depending on the specific circumstances, such as the type of vehicle or the driver’s driving record.

SR-22 Insurance and High-Risk Drivers

SR-22 insurance is often associated with high-risk drivers because it’s a requirement for individuals who have demonstrated a history of risky driving behavior. This type of insurance is designed to ensure that drivers who have been involved in accidents or have committed traffic violations maintain financial responsibility, protecting the public from potential financial burdens arising from their actions.

Factors Contributing to High-Risk Driver Status

A driver may be considered high-risk due to several factors, including:

- Multiple Traffic Violations: Drivers with a history of frequent traffic violations, such as speeding tickets, DUI convictions, or reckless driving, are often classified as high-risk.

- Accidents: Individuals who have been involved in multiple accidents, especially those resulting in significant damage or injuries, are also considered high-risk.

- Driving Under the Influence (DUI): DUI convictions are among the most serious driving offenses, significantly increasing a driver’s risk profile.

- License Suspension or Revocation: Having a driver’s license suspended or revoked due to traffic violations is a clear indicator of risky driving behavior.

- Uninsured or Underinsured Motorists: Drivers who have been found to be uninsured or underinsured, potentially leading to financial liability for others in accidents, are classified as high-risk.

Scenarios Leading to SR-22 Insurance Requirements

Several scenarios can trigger the requirement for SR-22 insurance:

- DUI Convictions: Most states mandate SR-22 insurance for drivers convicted of DUI offenses.

- License Suspension or Revocation: Drivers whose licenses have been suspended or revoked due to traffic violations often need SR-22 insurance to reinstate their driving privileges.

- Multiple Accidents: If a driver has been involved in multiple accidents, especially those resulting in significant financial liability, SR-22 insurance may be required.

- Failure to Pay Traffic Fines or Court Costs: Failing to fulfill financial obligations related to traffic violations can lead to SR-22 insurance requirements.

- High-Risk Driving Habits: Individuals with a history of reckless driving, speeding, or other dangerous driving behaviors may be mandated to carry SR-22 insurance.

SR-22 Insurance and State Regulations

SR-22 insurance requirements vary significantly across the United States, influenced by individual state laws and regulations. These regulations govern the process for obtaining, maintaining, and terminating SR-22 insurance, ensuring that drivers with a history of driving violations meet financial responsibility standards.

State-Specific SR-22 Regulations

State laws dictate the specific requirements for SR-22 insurance, including the duration of the filing period, the types of offenses triggering the requirement, and the process for filing and terminating the insurance. Understanding these variations is crucial for drivers navigating SR-22 insurance requirements.

Key Differences in SR-22 Regulations by State

The following table summarizes key differences in SR-22 regulations across various states:

| State | Filing Period | Offenses Triggering SR-22 | Filing Process | Termination Process |

|---|---|---|---|---|

| California | 3 years | DUI, reckless driving, hit-and-run | File with the DMV | File with the DMV upon completion of requirements |

| Florida | 5 years | DUI, reckless driving, multiple moving violations | File with the Department of Highway Safety and Motor Vehicles | File with the Department of Highway Safety and Motor Vehicles upon completion of requirements |

| Texas | 3 years | DUI, reckless driving, failure to pay traffic tickets | File with the Texas Department of Transportation | File with the Texas Department of Transportation upon completion of requirements |

| New York | 3 years | DUI, reckless driving, leaving the scene of an accident | File with the Department of Motor Vehicles | File with the Department of Motor Vehicles upon completion of requirements |

SR-22 Insurance and Legal Consequences

Driving without SR-22 insurance when required can have serious legal consequences, including fines, license suspension, and even jail time. It is crucial to understand the potential penalties associated with SR-22 insurance violations and to comply with all legal requirements.

Penalties and Fines for SR-22 Insurance Violations

Failing to maintain SR-22 insurance can result in various penalties and fines, depending on the state and the severity of the violation.

- Fines: States typically impose hefty fines for driving without SR-22 insurance, ranging from hundreds to thousands of dollars.

- License Suspension: Driving without required SR-22 insurance can lead to the immediate suspension of your driving privileges.

- Jail Time: In some cases, particularly for repeat offenders or those with serious driving offenses, driving without SR-22 insurance can result in jail time.

Real-Life Cases Illustrating the Consequences of Neglecting SR-22 Requirements

Several real-life cases demonstrate the serious consequences of neglecting SR-22 insurance requirements.

- Case 1: A driver in California was stopped for a traffic violation. Upon checking his records, the officer discovered the driver had an outstanding SR-22 requirement. The driver was issued a citation and his license was suspended until he provided proof of SR-22 insurance. The driver faced a fine of $500 and had to complete a driver safety course to reinstate his license.

- Case 2: A driver in Texas was involved in a hit-and-run accident. The driver fled the scene without providing his information. The police later identified the driver and discovered he had a previous SR-22 requirement. The driver was charged with hit-and-run, driving without SR-22 insurance, and fleeing the scene of an accident. He was sentenced to 30 days in jail and fined $1,000.

Wrap-Up

Navigating the world of SR-22 insurance can be daunting, but understanding its purpose, requirements, and potential implications can empower you to regain your driving privileges and maintain financial responsibility on the road. From seeking quotes from multiple insurance providers to diligently maintaining your driving record, proactive steps can help you navigate this process smoothly and avoid any legal or financial repercussions. Remember, SR-22 insurance is a vital tool for ensuring both your safety and financial security while driving.