Navigating the world of insurance can feel like deciphering a complex financial code. One term frequently encountered, yet often misunderstood, is “prorated.” This seemingly simple word holds significant implications for your premiums, refunds, and overall financial responsibility. Understanding what prorated means in insurance is crucial for both policyholders and those considering purchasing coverage. This guide unravels the complexities of prorated insurance, providing a clear and concise explanation, complete with practical examples and frequently asked questions.

Proration essentially refers to the adjustment of an insurance premium based on the actual time a policy is in effect. Instead of paying a full year’s premium upfront for a policy that only covers part of the year, the cost is proportionally reduced. This principle applies across various insurance types, from auto and homeowners to health and life, with nuances in calculation depending on the specific policy and insurer. Understanding this process empowers you to avoid unexpected costs and ensure you’re only paying for the coverage you receive.

Definition of Prorated Insurance

Prorated insurance refers to the adjustment of insurance premiums to reflect the exact coverage period. Instead of paying for a full policy term, you pay only for the portion of the term you are insured. This is particularly relevant when policies start or end mid-term, or when coverage changes during the policy’s duration. The calculation ensures fairness by aligning the premium with the actual time the insurance protection is in effect.

Prorated insurance premiums are a common practice, ensuring policyholders aren’t overcharged for coverage they don’t receive and insurers are fairly compensated for the risk they undertake. The core concept is simple: divide the total annual premium by the number of days in the year, then multiply by the number of days of actual coverage. This provides a precise premium amount reflecting the actual coverage period.

Examples of Prorated Insurance Policies

Prorated premiums are frequently used in various insurance types. For example, auto insurance often involves prorated payments when a policy is cancelled early or renewed mid-term. Homeowners insurance may also use prorating if a policy is terminated prematurely, or if coverage is modified during the policy period. Renters insurance, likewise, often applies prorated premiums under similar circumstances. Life insurance, while generally not subject to mid-term cancellations, might see prorated adjustments in specific circumstances such as changes in coverage amounts or policy riders. Health insurance policies, particularly short-term plans, commonly involve prorated premiums to align payments with the actual coverage duration.

Hypothetical Scenario: Calculating a Prorated Premium

Let’s imagine Sarah purchases a six-month auto insurance policy on July 15th for an annual premium of $1,200. The policy ends on January 14th of the following year. To calculate the prorated premium, we first determine the number of days in the policy period. From July 15th to January 14th, there are 183 days (approximately). Next, we calculate the daily premium: $1,200 / 365 days = $3.29 per day (approximately). Finally, we multiply the daily premium by the number of days of coverage: $3.29/day * 183 days = $601.37. Therefore, Sarah’s prorated premium for the six-month period would be approximately $601.37. Note that the exact calculation may vary slightly depending on the insurer’s specific method and the number of days in the months involved. The example demonstrates the fundamental principle of prorating, aligning premium payments with the exact coverage period.

Calculating Prorated Premiums

Prorated insurance premiums represent a fair and equitable distribution of costs based on the actual coverage period. Understanding the calculation method is crucial for both policyholders and insurers to ensure accurate billing and transparent financial transactions. This section details the process of calculating prorated premiums for various insurance types.

Calculating a prorated premium involves determining the daily or monthly cost of the insurance and then multiplying that by the number of days or months of coverage. The fundamental formula is straightforward, yet its application varies slightly depending on the specific policy and its terms.

Prorated Premium Calculation Formula

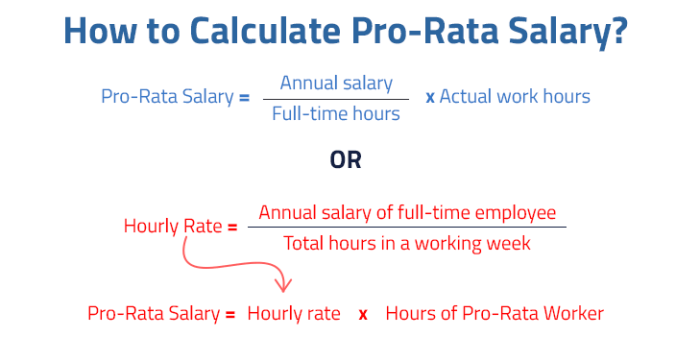

The core formula for calculating a prorated premium is:

Prorated Premium = (Total Annual Premium / Number of Days in the Year) * Number of Days of Coverage

This formula can be adapted for monthly calculations as well:

Prorated Premium = (Total Annual Premium / 12 months) * Number of Months of Coverage

The accuracy of this calculation hinges on the precision of the input values, specifically the total annual premium and the coverage period.

Calculating a Six-Month Prorated Premium

Let’s illustrate with a hypothetical example: Imagine a six-month car insurance policy starting July 1st and ending December 31st. The annual premium is $1,200.

First, we determine the daily rate: $1,200 / 365 days = $3.29 per day (approximately).

Next, we calculate the number of days of coverage: From July 1st to December 31st comprises 184 days (31 days in July + 31 in August + 30 in September + 31 in October + 30 in November + 31 in December).

Finally, we compute the prorated premium: $3.29/day * 184 days = $604.56. Therefore, the prorated premium for this six-month policy would be approximately $604.56.

Prorated Premium Calculation for Different Insurance Types

The fundamental calculation remains consistent across various insurance types; however, specific details may influence the process. For instance, homeowner’s insurance might include a separate calculation for liability coverage versus property coverage, potentially leading to a more complex breakdown. Similarly, life insurance prorating is generally not applicable as premiums are usually paid annually, semi-annually, or quarterly with a fixed cost for the entire period. Health insurance, often paid monthly, simplifies the prorated calculation to a monthly rate multiplied by the number of months of coverage. However, the specifics should always be checked in the insurance policy documentation.

Prorated Premiums

Prorated insurance premiums represent a proportional adjustment of the cost, reflecting the actual coverage period. This ensures fairness for both the insurer and the insured, particularly in situations involving policy cancellations, short-term coverage, or changes in coverage levels. Understanding how these calculations work is crucial for navigating insurance policies effectively.

Mid-Term Policy Cancellations and Refunds

When a policy is canceled mid-term, the insurer typically calculates a prorated refund based on the unused portion of the policy. This refund is determined by subtracting the premium already earned by the insurer from the total premium paid. The earned premium is calculated proportionally to the time the policy was in effect. For instance, if a policy is canceled after six months of a one-year term, the insurer has earned half of the annual premium, and the remaining half is returned to the insured. The specific calculation method may vary slightly depending on the insurer and the policy’s terms, but the core principle of proportionality remains consistent. Some policies may include cancellation fees, which are deducted from the refund amount. It is important to review the policy documentation to understand the specific refund process and any applicable fees.

Calculating a Prorated Refund for a Prepaid Annual Policy

Consider a scenario where an annual insurance policy with a premium of $1,200 is canceled after six months. The insurer’s earned premium for the six months of coverage is calculated as ($1,200 / 12 months) * 6 months = $600. The prorated refund is then calculated as the total premium paid minus the earned premium: $1,200 – $600 = $600. This $600 represents the refund owed to the policyholder. This calculation assumes no cancellation fees are applied. However, the policy’s specific terms and conditions should always be consulted for accurate calculations.

Prorated Premiums: Short-Term vs. Long-Term Policies

The calculation of prorated premiums for short-term and long-term policies follows the same fundamental principle of proportionality, but the impact of the time element differs. In a long-term policy, even a small change in the coverage period results in a significant difference in the prorated premium. For example, a cancellation after one month in a five-year policy will yield a much smaller refund than a similar cancellation in a six-month policy. Conversely, for short-term policies, the difference in the prorated premium will be less significant because the total premium is smaller, and the time difference between policy inception and cancellation is relatively small. The core calculation remains consistent: (Premium / Total Policy Period) * Coverage Period = Prorated Premium (or refund). The key difference lies in the magnitude of the resulting amounts. A long-term policy, spread over a longer duration, will have a larger potential for a larger prorated refund or premium.

Proration in Different Insurance Types

Proration, the process of adjusting insurance premiums to reflect the actual coverage period, varies significantly across different insurance types. Understanding these variations is crucial for policyholders to accurately assess their costs and ensure they are receiving the appropriate coverage for their payments. The specific application of proration hinges on the policy’s terms, the insurer’s practices, and the nature of the coverage itself.

Proration methods differ depending on the type of insurance policy. Auto, home, and health insurance each have unique considerations regarding how prorated premiums are calculated and applied.

Auto Insurance Proration

Auto insurance proration typically involves calculating the premium based on the number of days of coverage remaining in the policy period. For example, if a policyholder cancels their six-month policy after three months, the insurer will refund 50% of the premium, representing the unused portion of the policy term. However, cancellation fees may apply, reducing the amount refunded. In the case of a new policy, the premium may be prorated to reflect the remaining days in the current policy period if the coverage begins mid-term. Some insurers may also adjust for factors like mileage or driving habits if relevant to the policy’s structure, although this is less common for simple proration of premium amounts.

Home Insurance Proration

Similar to auto insurance, home insurance premiums are often prorated based on the policy’s remaining term. If a policyholder cancels their policy before its expiration, they will receive a refund for the unused portion. Conversely, if a policy is initiated mid-term, the initial premium will reflect only the remaining coverage period. The specific calculation may vary based on the insurer’s chosen method, with some using a daily or monthly proration calculation while others may use a more complex formula factoring in policy specifics. The presence of additional coverage features, such as flood or earthquake insurance, might also affect the proration calculations.

Health Insurance Proration

Health insurance proration is more complex than auto or home insurance. While some aspects of health insurance premiums, like those for short-term plans or supplemental coverage, may be prorated, the core aspects of most health insurance policies are not usually subject to proration. Instead, premiums are typically structured as monthly payments, regardless of when the policy begins or ends within the billing cycle. However, if a policy is canceled mid-month, the insurer might offer a partial refund for the remaining days. This is more common in individual plans than group plans, where billing is often handled by the employer. Also, changes to the plan’s coverage (such as adding or dropping dependents) often trigger adjustments to the premium, which may or may not involve a proration of the remaining period.

Comparison of Proration Across Insurance Types

| Insurance Type | Proration Basis | Common Calculation Method | Variations by Insurer |

|---|---|---|---|

| Auto | Days of coverage remaining | Daily or monthly | Cancellation fees, mileage-based adjustments (rare) |

| Home | Days of coverage remaining | Daily or monthly, potentially more complex formulas | Variations in calculation methods, impact of additional coverage |

| Health | Generally not prorated for core coverage | Monthly payments, partial refunds possible for mid-month cancellations | Differences in handling mid-month cancellations, adjustments for plan changes |

Factors Affecting Prorated Premiums

Prorated insurance premiums, while seemingly straightforward, are influenced by several factors beyond the simple calculation of the remaining coverage period. Understanding these nuances is crucial for both insurers and policyholders to ensure accurate and fair premium adjustments. These factors can significantly alter the final amount due or refunded.

Policy Cancellation Fees

Policy cancellation often incurs fees beyond the simple proration of the premium. These fees, typically Artikeld in the policy documents, can range from a flat fee to a percentage of the premium. For example, a policy might charge a $50 cancellation fee in addition to the prorated refund for unused coverage. The inclusion of these fees directly reduces the amount refunded to the policyholder. A significant cancellation fee could even result in a net payment to the insurer, even if the policy was canceled mid-term. These fees compensate the insurer for administrative costs associated with processing the cancellation and adjusting records.

Impact of Different Payment Schedules

The frequency of premium payments—whether monthly, quarterly, semi-annually, or annually—directly impacts the proration calculation. Annual policies, when canceled mid-term, result in a larger refund (or a larger remaining balance due) compared to monthly policies canceled at the same point in the policy year. For instance, canceling an annual policy halfway through would yield a 50% refund of the annual premium. Conversely, canceling a monthly policy halfway through the month would only result in a pro-rata refund for the unused portion of that specific month. This difference stems from the timing of payments and the overall premium distribution across the policy term.

Additional Fees and Charges

Beyond cancellation fees, other charges can affect the final prorated premium. These might include late payment penalties, if applicable, or administrative fees for specific policy changes or amendments made before cancellation. For example, a policyholder who consistently pays late might find their prorated refund reduced by accrued late fees. Similarly, if a policyholder requests changes to coverage mid-term, administrative fees associated with these changes could be factored into the final prorated amount. It’s crucial to review the policy documents to understand all potential fees that could impact the final calculation.

Understanding Policy Documents Regarding Proration

Navigating the complexities of insurance policy documents can be challenging, particularly when dealing with concepts like prorated premiums. Understanding where to find this information and interpreting the relevant clauses is crucial for ensuring you are paying the correct amount and receiving the appropriate coverage. Failure to thoroughly review these details can lead to unexpected costs or gaps in your protection.

Policyholders should meticulously examine their insurance policy documents to comprehend the mechanics of proration. This understanding prevents disputes and ensures accurate premium payments. Proactive review minimizes the risk of misunderstandings and protects the policyholder’s financial interests.

Locating Prorated Premium Information

Information on prorated premiums is typically found within the policy’s premium calculation section or a dedicated section outlining policy changes, cancellations, or refunds. Look for terms such as “short-rate cancellation,” “pro rata refund,” or “partial premium.” The policy will usually specify how the proration is calculated, often detailing the daily or monthly rate. Some policies may include a sample calculation to illustrate the process. In the absence of clear explanation, contacting the insurer directly is recommended to clarify any ambiguities.

Importance of Reviewing Policy Terms Before Signing

Before signing any insurance policy agreement, a thorough review of all terms and conditions is paramount. This includes carefully examining the sections related to premium calculations, particularly those addressing proration. Understanding how premiums are calculated in different scenarios – such as mid-term policy changes, cancellations, or returns of unearned premiums – is essential for avoiding unexpected financial burdens. Overlooking these details can lead to disputes and potentially costly corrections later. The policy should be reviewed and understood before committing to the agreement.

Understanding Proration Language in Insurance Policies

Insurance policies often employ specialized terminology. Terms like “pro rata,” “short rate,” and “earned premium” require careful interpretation. “Pro rata” signifies a proportionate distribution based on the time the coverage was in effect. “Short rate” usually indicates a penalty applied when a policy is canceled before its expiration date. “Earned premium” refers to the portion of the premium that corresponds to the period of coverage already provided. Understanding these terms is crucial to interpreting the policy’s proration clauses accurately. If any terms remain unclear, seeking clarification from the insurer is advisable. Examples of these terms in action should be clearly Artikeld within the policy document. For instance, a policy might state: “In the event of cancellation, the unearned premium will be returned on a pro rata basis, less a short-rate penalty of X%.”

Proration and Policy Renewals

Policy renewal often involves prorated premiums, particularly when the policy’s anniversary date doesn’t align with the end of a billing cycle. Understanding how these prorated premiums are calculated is crucial for both insurers and policyholders to ensure accurate and fair billing. This section details the mechanics of prorated premiums during policy renewals and highlights the differences between standard and prorated renewal premiums.

Prorated renewal premiums differ from standard renewal premiums primarily in their calculation period. A standard renewal premium covers a full policy term, typically a year. In contrast, a prorated renewal premium covers only a portion of the policy term, reflecting the remaining coverage period from the renewal date to the next policy anniversary. This discrepancy arises when a policy is renewed mid-term, either due to a change in coverage or a shift in billing cycles.

Prorated Renewal Premium Calculation

Calculating a prorated renewal premium requires determining the number of days remaining in the current policy term after the renewal date. This is then used to calculate a daily rate, which is multiplied by the number of days remaining to arrive at the prorated premium. For example, consider a one-year policy with an annual premium of $1,200 that is renewed six months into the policy term. The daily rate is calculated as $1,200 / 365 days = $3.29 per day (approximately). The remaining coverage period is 183 days (6 months). Therefore, the prorated renewal premium would be 183 days * $3.29/day = $601.47 (approximately). This figure represents the cost of coverage for the remaining six months of the policy year. Any additional premium adjustments, such as increases based on risk assessment or market conditions, are added to this prorated amount.

Difference Between Prorated and Standard Renewal Premiums

The key distinction lies in the duration covered. A standard renewal premium covers a full policy period (e.g., one year), while a prorated renewal premium covers only the remaining portion of the policy period after the renewal date. A standard renewal premium is straightforward: it’s the full annual premium (or other term) as determined by the insurer’s rates for that specific policy. In contrast, the prorated renewal premium is a fraction of the full annual premium, calculated proportionally to the remaining coverage period. The calculation is directly influenced by the renewal date and the policy term length. For instance, a renewal occurring halfway through the policy year would result in a prorated premium approximately half the size of a standard renewal premium. However, it is important to note that any increases in premiums based on risk or market factors would still apply to the prorated portion.

Common Misconceptions about Prorated Insurance

Prorated insurance, while straightforward in principle, often leads to misunderstandings due to its nuanced application across various insurance types and policy structures. Many misconceptions stem from a lack of clarity regarding the calculation process and the impact of specific policy details. This section addresses some prevalent inaccuracies to promote a clearer understanding.

Many individuals mistakenly believe that prorated insurance premiums are simply a proportional division of the annual premium based solely on the number of days covered. While this is a foundational element, it often overlooks crucial factors like policy type, coverage periods, and any applicable discounts or surcharges. This can result in incorrect premium estimations, leading to disputes or unexpected costs.

Incorrect Assumptions Regarding Policy Start and End Dates

A common misconception centers on the precise determination of the policy’s effective start and end dates for prorating. For instance, some assume the policy begins on the date the application is submitted or the premium is paid, rather than the official inception date specified in the policy document. Similarly, the policy’s termination date might be misinterpreted, leading to inaccurate calculations. For example, if a policy is canceled mid-term, the prorated refund might be incorrectly calculated based on the date of cancellation notification rather than the official cancellation date Artikeld in the policy terms. This often leads to discrepancies between the insured’s expectation and the insurer’s calculation.

Misunderstanding of Short-Term Policies and Their Proration

Short-term policies, often purchased for specific events or temporary needs, are particularly prone to misinterpretations regarding proration. Individuals might incorrectly assume that the daily rate is a simple division of the annual premium by 365, neglecting the fact that insurers often employ different rate structures for shorter coverage periods, reflecting higher administrative costs or increased risk. This can result in a higher-than-expected premium for a short-term policy compared to the pro-rata calculation based on the annual rate. For example, a short-term car insurance policy for a month might not be one-twelfth of the annual premium, but instead a slightly higher rate due to the insurer’s cost structure.

Ignoring the Impact of Discounts and Surcharges on Prorated Premiums

Another frequent misunderstanding involves the application of discounts and surcharges to prorated premiums. Some assume that these adjustments are applied to the full annual premium before proration, while others believe they are applied only to the prorated portion. The correct application depends on the specific policy and insurer’s practices, and this variation often causes confusion. For instance, a multi-car discount might be applied to the entire annual premium before calculating the prorated portion for a single car’s coverage, leading to a different result than applying the discount only to the prorated premium for that individual car.

Failure to Account for Policy Fees and Other Charges

Beyond the premium itself, other charges, such as policy fees or administrative costs, might be subject to proration. However, many overlook this aspect, leading to unexpected charges or discrepancies. For example, a policy might have a one-time application fee that’s not prorated, while other charges, such as a monthly service fee, are prorated based on the actual coverage period. A clear understanding of which charges are prorated and which are not is crucial for accurate premium estimation.

Illustrative Examples of Prorated Insurance Scenarios

Understanding prorated insurance requires examining real-world applications. The following scenarios illustrate how prorated premiums are calculated across different insurance types and situations. Each example demonstrates the calculation process and resulting prorated amount, highlighting the practical implications of this common insurance practice.

Auto Insurance Proration After Mid-Month Cancellation

Imagine Sarah cancels her six-month auto insurance policy, costing $600 annually, after two months. Her insurer will prorate the remaining four months. The monthly premium is $600 / 6 months = $100. The prorated refund for the four unused months is $100/month * 4 months = $400. Sarah receives a $400 refund.

Homeowners Insurance Proration Upon Early Policy Purchase

John purchases a homeowners insurance policy mid-year, specifically on July 15th, for an annual premium of $1200. The policy’s term begins on July 15th and runs through July 14th of the following year. The insurer will prorate the premium from July 15th to the end of the year. There are 171 days remaining in the year (365 days – 194 days). The daily premium is $1200 / 365 days ≈ $3.29. The prorated premium for the remainder of the year is approximately $3.29/day * 171 days ≈ $562.29. John pays $562.29 for the remainder of the policy year.

Renters Insurance Proration During a Short-Term Lease

Maria rents an apartment for three months, and her renters insurance policy costs $150 annually. The insurer prorates the premium based on the three-month lease. The monthly premium is $150 / 12 months = $12.50. The prorated premium for three months is $12.50/month * 3 months = $37.50. Maria pays $37.50 for her three-month renters insurance coverage.

Life Insurance Proration and Policy Changes

David increases his life insurance coverage mid-term. The additional coverage will be prorated from the effective date of the increase to the end of the policy period. Assume the annual premium increase is $200, and the change occurs on October 1st. There are 92 days remaining in the year (365 days – 273 days). The daily premium increase is $200 / 365 days ≈ $0.55. The prorated premium increase for the remainder of the year is approximately $0.55/day * 92 days ≈ $50.60. David pays an additional $50.60 for the increased coverage for the remainder of the year.

Resources for Further Information on Prorated Insurance

Navigating the complexities of insurance proration can be challenging, but several resources provide valuable information to enhance understanding and ensure accurate calculations. Accessing reliable sources is crucial for consumers and professionals alike to make informed decisions regarding insurance policies and premium payments. This section Artikels key resources for further exploration of this topic.

Reliable information on insurance is readily available from various sources, offering detailed explanations of proration and its implications across different insurance types. These resources cater to diverse levels of understanding, providing both general overviews and in-depth analyses for those seeking a comprehensive understanding.

Government and Regulatory Agencies

Governmental agencies and regulatory bodies often publish comprehensive guides and resources on insurance practices. These resources typically include information on consumer rights, policy details, and regulatory requirements. For example, the websites of state insurance departments often provide detailed explanations of insurance regulations, including those related to proration. These departments often offer consumer guides that explain insurance terminology in plain language. Additionally, the National Association of Insurance Commissioners (NAIC) provides a wealth of information on insurance regulations and consumer protection across all states.

Industry Associations and Professional Organizations

Professional organizations within the insurance industry often publish articles, white papers, and other resources that provide insights into specific aspects of insurance, including proration. These resources often delve into the technical details of calculations and offer best practices for both insurers and consumers. Membership in such organizations may provide access to additional resources and expert networks.

Insurance Company Websites

Many insurance companies provide detailed information on their websites, including explanations of their policies and procedures regarding proration. While the information may be presented with a focus on their specific products, it can still provide valuable insights into common practices within the industry. Carefully reviewing the policy documents and frequently asked questions (FAQs) sections of a particular insurer’s website can be a valuable step in understanding their approach to proration.

Financial and Insurance Publications

Reputable financial publications and journals often feature articles that discuss various aspects of insurance, including proration. These articles can provide analyses of industry trends, insights into best practices, and explanations of complex insurance concepts. Searching for relevant s in databases such as JSTOR or EBSCOhost can yield valuable research papers and articles focusing on specific facets of insurance proration.

Consulting with Insurance Professionals

Consulting with an experienced insurance professional offers personalized guidance tailored to individual circumstances. Insurance brokers and agents possess in-depth knowledge of insurance products and regulations, enabling them to provide clear explanations, address specific questions, and assist in navigating the complexities of insurance proration. Their expertise ensures accurate interpretation of policy documents and appropriate application of proration principles in specific scenarios. This personalized approach is particularly valuable for complex situations or when dealing with specialized insurance types.

Closing Summary

In conclusion, understanding the concept of prorated insurance premiums is essential for managing your insurance costs effectively. Whether you’re dealing with a mid-term cancellation, a short-term policy, or a renewal, grasping the principles of proration allows you to accurately calculate your payments and avoid any potential financial surprises. While the specific calculations can vary based on policy details and insurer practices, the core concept remains consistent: a fair adjustment of premiums based on the duration of coverage. Always refer to your policy documents and contact your insurer if you have any doubts or require clarification.