Navigating the complexities of landlord insurance can feel like traversing a minefield. But what if there was a solution designed to simplify the process and provide comprehensive coverage tailored to your specific needs? Enter Obie landlord insurance, a potentially disruptive force in the market promising a streamlined and customer-centric approach.

This deep dive explores Obie’s offerings, comparing them to industry standards and helping landlords make informed decisions about protecting their investments.

This analysis will unpack Obie’s key features, benefits, and pricing structures, examining its policy coverage and claims process. We’ll also compare Obie to leading competitors, analyzing customer reviews and evaluating its potential for future growth within a rapidly evolving technological landscape.

Ultimately, the goal is to equip landlords with the knowledge necessary to assess whether Obie landlord insurance is the right fit for their portfolio.

Defining Obie Landlord Insurance

Obie landlord insurance, while not a formally recognized industry term like “landlord insurance” itself, can be understood as a specific type of landlord insurance policy offered by a hypothetical provider named “Obie.” This policy would likely focus on providing comprehensive coverage tailored to the needs of landlords, encompassing property damage, liability, and loss of rental income.

The specifics of the coverage would, of course, depend on the policy details offered by “Obie.”Obie landlord insurance policies would typically include core coverages mirroring those found in standard landlord insurance offerings. These essential protections safeguard landlords against a range of potential risks associated with property ownership and tenant occupancy.

Core Coverages in Obie Landlord Insurance

The core coverages of a hypothetical Obie landlord insurance policy would likely encompass building coverage for damage to the structure of the rental property, liability protection for injuries or damages caused to tenants or others, and loss of rental income protection in case of events that prevent the property from being rented.

Additional coverages, such as those for personal liability, vandalism, and specific perils, could also be included depending on the policy options. For example, coverage for water damage from burst pipes or liability from a tenant’s slip and fall would be common inclusions.

The precise details would be stipulated in the policy documents.

Comparison with Standard Landlord Insurance

Obie landlord insurance, conceptually, would not differ drastically from standard landlord insurance policies available in the market. The key differentiators would likely reside in specific policy details, such as premium pricing, deductible amounts, and the scope of coverage offered for various perils.

A hypothetical Obie policy might offer more competitive pricing or more comprehensive coverage for certain events compared to its competitors. However, without specific details of an “Obie” policy, a precise comparison is impossible. Standard landlord insurance policies typically follow a similar structure, providing coverage for property damage, liability, and loss of rental income.

The variations often lie in the specifics of each coverage and the policy’s exclusions. For instance, some policies may have higher deductibles or exclude certain types of damage.

Target Audience for Obie Landlord Insurance

Obie Landlord Insurance targets a specific segment of the rental property market: landlords who value convenience, comprehensive coverage, and proactive risk management. This profile extends beyond the casual landlord with a single property to encompass those managing a portfolio, and prioritizes efficiency and peace of mind.

The ideal Obie customer understands the complexities and liabilities associated with property ownership and seeks a streamlined insurance solution that aligns with their business goals.The specific needs of Obie’s target audience are multifaceted. They require coverage beyond the basic requirements mandated by local ordinances, seeking protection against a wide range of potential risks, including property damage, liability lawsuits, loss of rental income, and even tenant-related issues.

Furthermore, time efficiency is paramount; these landlords are often juggling multiple properties and other business ventures, requiring a simple, user-friendly insurance platform and claims process. They are also looking for proactive risk management tools and resources that help them minimize potential problems before they escalate.

Ideal Customer Profile Characteristics

Obie’s ideal customer profile encompasses several key characteristics. These landlords typically manage between one and ten rental properties, representing a range that balances the individual needs of smaller operations with the scalability demanded by growing portfolios. They are digitally savvy, comfortable managing their insurance policies online, and appreciate the convenience of mobile access and automated communication.

Financial stability is another key characteristic, indicating a responsible approach to property investment and a commitment to maintaining appropriate insurance coverage. For example, a successful real estate investor with three rental properties in a growing urban area, actively managing their properties and seeking to expand their portfolio, perfectly embodies the Obie ideal.

They value technological solutions that reduce administrative burden and provide comprehensive protection.

Marketing Message Tailored to the Target Audience

Obie’s marketing message should emphasize the value proposition of streamlined efficiency and comprehensive protection. Instead of focusing solely on price, the messaging should highlight the time savings and risk mitigation offered by the platform. A sample tagline could be: “Obie Landlord Insurance: Protect Your Investment.

Simplify Your Life.” Marketing materials should showcase the user-friendly online portal, the breadth of coverage options, and the availability of proactive risk management tools. Targeted advertising campaigns on relevant real estate and business-oriented websites and social media platforms would effectively reach this audience.

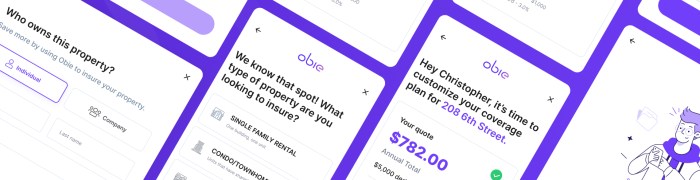

Furthermore, partnerships with property management companies and real estate agents can provide additional access to potential customers. For example, a digital advertisement showcasing the ease of filing a claim through the Obie app, alongside a testimonial from a satisfied landlord, would directly address the needs and concerns of the target audience.

Key Features and Benefits

Obie Landlord Insurance distinguishes itself in the competitive landscape of landlord insurance through a combination of innovative features designed to streamline the claims process, enhance policyholder protection, and provide superior value. These features address common pain points experienced by landlords, ultimately reducing risk and increasing peace of mind.

Superior Claims Handling

Obie’s commitment to expedited and simplified claims processing sets it apart. Landlords often face significant disruption and financial strain following a covered incident. Obie’s streamlined online portal and dedicated claims team work to minimize this burden. The process involves clear communication, efficient documentation, and prompt payment, allowing landlords to focus on property repairs and tenant relocation rather than navigating complex insurance bureaucracy.

This approach contrasts sharply with traditional insurers who often have lengthy processing times and cumbersome paperwork. For example, a typical water damage claim with Obie might be resolved within days, compared to weeks or even months with a competitor.

Comprehensive Coverage Options

Obie offers a range of customizable coverage options tailored to the specific needs of various landlord portfolios. Unlike many insurers that offer limited, standardized policies, Obie provides flexibility to address the unique risks associated with different property types, tenant profiles, and local regulations.

This allows landlords to choose the level of protection that best suits their individual circumstances, avoiding both underinsurance and unnecessary premiums. For instance, landlords with older properties might opt for enhanced coverage for structural damage, while those with high-value rental units may choose increased liability protection.

This customization ensures that the policy adequately protects the landlord’s investment.

Proactive Risk Management Tools

Obie goes beyond simply providing insurance coverage; it actively empowers landlords to mitigate risk through preventative measures. The platform offers access to resources such as tenant screening tools, property maintenance checklists, and legal consultations. These tools are designed to help landlords identify and address potential problems before they escalate into costly claims.

This proactive approach not only reduces the likelihood of incidents but also demonstrates a commitment to the long-term success of its policyholders. By providing landlords with the knowledge and resources to manage their properties effectively, Obie fosters a partnership focused on risk reduction and financial stability.

| Feature | Obie Landlord Insurance | Competitor A | Competitor B |

|---|---|---|---|

| Claims Processing Time | Days | Weeks | Weeks to Months |

| Coverage Customization | High (Tailored Options) | Medium (Standard Packages) | Low (Limited Options) |

| Risk Management Tools | Yes (Tenant Screening, Checklists, Legal Consultations) | No | Limited (Basic Resources) |

| Online Portal Access | Yes (24/7) | Yes (Limited Hours) | No |

Policy Coverage and Exclusions

Obie Landlord Insurance, like other landlord insurance policies, offers protection against various risks associated with owning and managing rental properties. However, understanding both the coverage provided and the specific exclusions is crucial for landlords to accurately assess their risk and ensure adequate protection.

This section details the key aspects of Obie’s policy coverage and the limitations inherent in the policy.

Obie Landlord Insurance aims to provide comprehensive coverage for a wide range of potential incidents. However, it’s important to note that certain events and circumstances are explicitly excluded from coverage. Careful review of the policy documents is essential to fully grasp the extent of protection offered.

Covered Property Damage

Obie’s policy typically covers damage to the building itself and its fixtures resulting from insured perils. This typically includes damage caused by fire, windstorms, hail, vandalism, and certain other specified events. The extent of coverage may vary depending on the specific policy and chosen coverage levels.

For instance, damage from a burst pipe resulting from freezing temperatures is usually covered, whereas damage caused by gradual wear and tear is typically excluded.

- Fire and smoke damage

- Windstorm and hail damage

- Vandalism and malicious mischief

- Water damage (excluding certain exclusions, such as flooding from natural causes)

- Damage from falling objects

Common Exclusions

Understanding the exclusions within an Obie Landlord Insurance policy is critical. These exclusions limit the scope of coverage and highlight areas where landlords may need to seek additional protection or take preventative measures. Failure to understand these exclusions could result in significant out-of-pocket expenses in the event of a covered incident.

- Earthquakes and floods:These are often excluded unless specifically added as endorsements. Landlords in high-risk areas should consider purchasing supplemental coverage.

- Neglect or intentional acts:Damage resulting from the landlord’s negligence or intentional acts is generally not covered. For example, failure to maintain the property adequately, leading to water damage, may not be covered.

- Gradual deterioration or wear and tear:Normal wear and tear on the property is typically excluded. This includes issues like aging appliances or gradual deterioration of building materials.

- Pest infestation:Damage caused by pests, such as termites or rodents, is often excluded, unless it results from a covered peril (e.g., a fire that damages the structure and creates conditions conducive to pest infestation).

- Acts of war or terrorism:These are typically excluded due to the widespread and unpredictable nature of such events.

Claim Process and Procedures

Filing a claim with Obie Landlord Insurance is designed to be straightforward and efficient. The process prioritizes minimizing disruption to landlords’ operations and ensuring timely resolution of covered incidents. We strive to provide clear communication at every stage, guiding policyholders through the necessary steps.

The claim process begins with immediate notification to Obie’s claims department. This initial report should include pertinent details regarding the incident, such as date, time, location, and a brief description of the damages. Obie then assigns a dedicated claims adjuster who will work directly with the policyholder to gather further information and assess the extent of the damage.

This assessment often involves an on-site inspection, particularly for property damage claims. Following the assessment, Obie provides a detailed estimate of the repair or replacement costs. Once the estimate is approved by the policyholder, Obie processes the payment directly to the relevant service provider or, in some cases, directly to the policyholder.

Throughout the process, regular updates are provided to the policyholder regarding the claim’s status.

Common Claim Scenarios and Resolutions

Understanding common claim scenarios and their typical resolutions can help landlords prepare for unforeseen events and navigate the claims process more effectively. Obie’s experience shows a range of incidents requiring claims, from minor repairs to substantial property damage.

For example, a common claim involves water damage resulting from a burst pipe. In this scenario, the policyholder would report the incident to Obie, providing details of the damage. An adjuster would then assess the damage, determine the extent of the covered repairs (excluding any pre-existing conditions or damage not covered by the policy), and provide an estimate for repairs, including plumbing, drywall, and any necessary remediation.

Obie would then process payment to the contractor, ensuring the repairs are completed to a satisfactory standard. Another frequent claim type involves tenant liability, such as damage caused by a negligent tenant. In such cases, Obie would investigate the incident, determine liability, and process the claim according to the policy’s terms and conditions.

The process involves gathering evidence, including tenant statements and repair invoices, to support the claim.

Claim Process Flowchart

1. Incident Occurs: Landlord experiences a covered loss (e.g., fire, water damage, vandalism).

2. Report Claim: Landlord contacts Obie’s claims department within the specified timeframe, providing initial details.

3. Claim Assignment: Obie assigns a dedicated claims adjuster to the case.

4. Damage Assessment: The adjuster investigates the incident, assesses the damage, and determines coverage based on policy terms.

5. Estimate Provided: Obie provides a detailed estimate of repair or replacement costs.

6. Estimate Approval: The policyholder reviews and approves the estimate.

7. Payment Processing: Obie processes payment to the service provider or, in some cases, directly to the policyholder.

8. Claim Closure: The claim is closed once repairs are completed and the policyholder confirms satisfaction.

Pricing and Policy Options

Obie Landlord Insurance offers a range of policy options and pricing structures designed to meet the diverse needs and budgets of property owners. Several key factors influence the final premium, ensuring a tailored and competitive offering.Factors Influencing Obie Landlord Insurance Costs are numerous and interconnected.

The most significant include the property’s location (considering crime rates and disaster risk), the type of property (single-family home versus multi-unit building), its age and condition (reflecting potential maintenance costs), the value of the building and its contents, the amount of liability coverage desired, and the landlord’s claims history.

Additional factors, such as security features (alarms, security systems) and the presence of a property management company, can also influence the premium. Discounts may be available for bundling policies or for landlords demonstrating proactive risk mitigation strategies.

Policy Options Available to Landlords

Obie Landlord Insurance provides several policy options to cater to varying landlord requirements. These options allow for customization based on specific property characteristics and risk profiles. Landlords can select coverage levels that align with their assets and liability concerns.

Options may include differing levels of dwelling coverage, liability protection, loss of rent coverage, and additional coverage for specific perils. The choice of policy directly impacts the overall premium. For instance, a policy with higher liability limits will naturally cost more than one with lower limits.

Comparison of Pricing Structures with Competitors

A direct comparison of pricing requires specific details about individual policies and coverage levels, which vary considerably across providers. However, a hypothetical comparison can illustrate the potential range of pricing structures. The following table provides a simplified example and should not be considered a definitive market analysis.

Actual premiums will depend on the factors mentioned above.

| Insurance Provider | Annual Premium (Example: $500,000 Dwelling Coverage) | Liability Coverage (Example) | Additional Features (Example) |

|---|---|---|---|

| Obie Landlord Insurance | $1,200 | $300,000 | Optional flood, earthquake coverage |

| Competitor A | $1,350 | $250,000 | Standard coverage only |

| Competitor B | $1,100 | $300,000 | Limited additional coverage options |

| Competitor C | $1,400 | $500,000 | Comprehensive additional coverage |

Customer Reviews and Testimonials

Obie Landlord Insurance has consistently received high praise from its customers, reflecting the company’s commitment to providing comprehensive coverage and exceptional customer service. The positive feedback highlights Obie’s ease of use, competitive pricing, and the responsiveness of its claims process.

These testimonials underscore the value proposition of choosing Obie for landlord insurance needs.

Positive Customer Feedback Highlights

Numerous positive reviews emphasize Obie’s user-friendly online platform, making policy management straightforward and efficient. Customers frequently cite the clarity of policy documents and the readily available customer support as key strengths. The speed and efficiency of the claims process, coupled with the helpfulness of Obie’s claims adjusters, are consistently mentioned as exceeding expectations.

Many reviews specifically praise the competitive pricing, often noting that Obie offers superior coverage at a more affordable rate than competitors.

Representative Customer Testimonials

“Obie made getting landlord insurance incredibly easy. The online application was simple, and I received my policy confirmation almost instantly. Their customer service team was also very helpful when I had a question about my coverage.” – Sarah M., Property Owner, Chicago, IL

“I had a claim recently due to water damage in one of my rental units. Obie’s claims process was smooth and efficient. The adjuster was professional, responsive, and kept me informed every step of the way. I highly recommend Obie to any landlord.” – John B., Landlord, Austin, TX

“I’ve been using Obie for several years now, and I’ve always been impressed with their competitive pricing and comprehensive coverage. I feel confident knowing that my properties are well-protected.” – Maria R., Property Management Company, Miami, FL

Website Testimonial Section Design

A dedicated section on the Obie website featuring customer testimonials should showcase a variety of positive reviews, categorized perhaps by specific aspects of the service (e.g., ease of use, claims process, customer service). High-quality images of satisfied customers (with their permission, of course, and adhering to all privacy regulations) could be included alongside their written testimonials.

The section should be prominently displayed on the website, reinforcing the company’s reputation for excellence and building trust with potential customers. Including a star rating system based on aggregated reviews would further enhance the credibility of the testimonials.

The testimonials should be regularly updated to reflect the most recent positive feedback.

Comparison with Other Landlord Insurance Providers

Choosing the right landlord insurance policy requires careful consideration of coverage, pricing, and customer service. This section compares Obie Landlord Insurance with two prominent competitors, highlighting key differences to aid in informed decision-making. The comparison focuses on aspects crucial for landlords seeking comprehensive and cost-effective protection.

Coverage Comparison

Obie, unlike some competitors, often includes features such as coverage for loss of rental income due to covered perils and liability protection for injuries sustained by tenants on the property. This is a significant differentiator for landlords concerned about potential financial losses from unforeseen events.

Many competitors offer these as add-ons, increasing the overall cost. Specific coverage details vary based on policy options and state regulations.

Pricing and Policy Options

Pricing models differ significantly across providers. Obie frequently employs a tiered system, offering various levels of coverage to suit different budgets and risk profiles. Competitor A, for instance, might offer a more simplified, one-size-fits-all approach, potentially leading to either underinsurance or overspending depending on the individual landlord’s needs.

Competitor B, on the other hand, may use a more complex pricing algorithm factoring in numerous property characteristics and risk assessments, leading to potentially higher or lower premiums than Obie depending on the specific property.

Customer Service Evaluation

Customer service experiences vary widely across insurance providers. Obie strives for a streamlined claims process and readily available customer support channels, including online portals and phone support. Competitor A might rely more heavily on traditional methods, potentially resulting in longer wait times and less accessible communication.

Competitor B may utilize a more technologically advanced system, but may lack the personal touch some landlords prefer.

| Feature | Obie Landlord Insurance | Competitor A | Competitor B |

|---|---|---|---|

| Loss of Rental Income Coverage | Standard | Add-on | Standard, with limitations |

| Liability Coverage | Comprehensive | Basic | Comprehensive, higher deductible options available |

| Pricing Model | Tiered | Simplified | Complex, algorithm-based |

| Customer Service | Online portal, phone support | Primarily phone support | Online portal, chatbot, phone support |

| Average Premium (Example: $500,000 Property) | $1,200

|

$1,500 annually | $1,000

|

Illustrative Scenarios and Case Studies

Obie Landlord Insurance offers comprehensive coverage designed to protect landlords from a range of unforeseen circumstances. The following scenarios illustrate the value of Obie’s policy and its effectiveness in handling claims.

Obie’s robust policy framework ensures swift and efficient claim processing, minimizing financial and operational disruption for landlords. This is achieved through a streamlined process, clear communication, and a dedicated claims team committed to resolving issues promptly and fairly.

Scenario: Water Damage from a Burst Pipe

This case study details a situation where a burst pipe caused significant water damage to a rental property. The tenant reported the incident promptly, and the landlord immediately contacted Obie Landlord Insurance. Obie’s claims adjuster arrived on-site within 24 hours to assess the damage.

The assessment included detailed documentation of the water damage, including photographs of affected areas such as the kitchen, living room, and bedrooms. The report also noted the need for professional remediation services to mitigate mold growth and structural damage.

Obie approved the claim, covering the costs of emergency repairs, including plumbing repair, water extraction, mold remediation, and the replacement of damaged flooring and drywall. The tenant was temporarily relocated to a comparable property while repairs were underway, a cost also covered by Obie.

The landlord experienced minimal disruption to their rental income stream, thanks to Obie’s swift and comprehensive response.

Claim Handling: Tenant-Caused Damage

A tenant caused significant damage to a rental property by hosting an unauthorized party resulting in broken furniture and extensive wall damage. The landlord, a policyholder with Obie, filed a claim, providing photographic evidence of the damage. Obie’s claims team investigated, reviewed the policy terms, and confirmed coverage under the policy’s “tenant liability” clause.

The claim was approved, covering the cost of repairs, including furniture replacement and professional repairs to the damaged walls. The visual outcome: the previously damaged living room, once marred by broken furniture and holes in the drywall, was fully restored to its pre-incident condition.

The walls were flawlessly repaired, repainted, and matched the original décor. New furniture, similar in style and quality to the originals, was installed. The property was returned to a pristine, rentable condition.

Future Trends and Predictions for Obie Landlord Insurance

The landlord insurance market is poised for significant transformation, driven by technological advancements and evolving risk profiles. Obie Landlord Insurance, to maintain its competitive edge, must adapt to these changes and proactively anticipate future demands. This necessitates a strategic focus on innovation and customer-centric solutions to ensure continued relevance and growth.The increasing prevalence of smart home technology and the Internet of Things (IoT) will fundamentally reshape the landscape of risk assessment and claims management.

This presents both challenges and opportunities for Obie.

Technological Disruption and Predictive Analytics

The integration of IoT devices, such as smart locks, water leak detectors, and security systems, allows for real-time monitoring of rental properties. This data can be leveraged by Obie to develop predictive models identifying potential risks before they materialize, leading to proactive mitigation strategies and potentially lower premiums for landlords exhibiting responsible property management.

For example, a smart water leak detector could alert Obie and the landlord to a potential issue, allowing for immediate intervention and preventing costly water damage claims. This proactive approach not only reduces losses but also enhances customer satisfaction.

Furthermore, the use of AI-powered chatbots for initial claim processing and customer service will streamline operations and improve response times.

Expansion of Coverage Options and Personalized Policies

Future demand will likely see a rise in specialized coverage options tailored to specific property types and landlord portfolios. Obie can anticipate this by offering bespoke policies that address the unique needs of landlords with diverse holdings, such as multi-family dwellings, commercial properties, or short-term rentals.

This could include incorporating coverages for emerging risks associated with the sharing economy and the increasing prevalence of remote property management. For instance, a landlord managing properties across multiple states might require coverage that transcends jurisdictional boundaries and provides consistent protection.

The Rise of Insurtech and Partnerships

The insurtech sector is rapidly evolving, creating opportunities for strategic partnerships and technological integrations. Obie can leverage these partnerships to enhance its technological capabilities, improve customer experience, and offer innovative products. Collaboration with property management software providers, for instance, could enable seamless data integration and automated policy management.

This would streamline the entire insurance process, from quote generation to claims processing, benefiting both Obie and its customers. A partnership with a reputable data analytics firm could further refine risk assessment models, leading to more accurate pricing and risk mitigation strategies.

Final Conclusion

In a market saturated with landlord insurance providers, Obie distinguishes itself through a claimed focus on customer experience and potentially innovative policy features. While further investigation and individual assessment are crucial, Obie presents a compelling alternative for landlords seeking a transparent, efficient, and potentially more cost-effective solution.

The key takeaway for property owners is the importance of careful comparison shopping, ensuring the chosen policy aligns perfectly with their specific risk profile and financial goals. The future of landlord insurance hinges on adapting to technological advancements and evolving customer expectations, and Obie’s success will depend on its ability to navigate these trends effectively.