Mortgage insurance, a financial safety net for lenders, can be a significant expense for homebuyers. While often a requirement for borrowers with lower down payments, understanding the factors that influence its cost is crucial for making informed financial decisions. This guide delves into the complexities of mortgage insurance, exploring its purpose, cost determinants, and strategies for minimizing its impact on your homeownership journey.

From deciphering the intricacies of loan-to-value ratios and credit score impacts to navigating the intricacies of mortgage insurance cancellation and refinancing, this comprehensive analysis equips you with the knowledge to navigate the world of mortgage insurance with confidence. Whether you’re a first-time homebuyer or a seasoned investor, understanding mortgage insurance is essential for achieving your homeownership goals.

What is Mortgage Insurance?

Mortgage insurance is a type of insurance that protects lenders against losses if a borrower defaults on their mortgage loan. It is essentially a safety net for lenders, allowing them to recoup some of their losses if a borrower is unable to make their mortgage payments.

Purpose of Mortgage Insurance

Mortgage insurance serves a crucial purpose in the mortgage lending process. It helps to mitigate the risk for lenders by providing financial protection against potential losses due to borrower default. This, in turn, allows lenders to offer more favorable terms to borrowers, such as lower interest rates and more flexible loan options.

Types of Mortgage Insurance

There are two main types of mortgage insurance: Private Mortgage Insurance (PMI) and Mortgage Insurance Premium (MIP).

Private Mortgage Insurance (PMI)

PMI is typically required for conventional loans, which are loans not backed by the federal government. It is usually required when a borrower makes a down payment of less than 20% of the purchase price.

Mortgage Insurance Premium (MIP)

MIP is required for Federal Housing Administration (FHA) loans, which are insured by the federal government. MIP is paid as a monthly premium and is calculated as a percentage of the loan amount.

Situations Where Mortgage Insurance is Required

Mortgage insurance is typically required in the following situations:

- When a borrower makes a down payment of less than 20% of the purchase price for a conventional loan.

- When a borrower obtains an FHA loan, regardless of the down payment amount.

- In some cases, lenders may require mortgage insurance even if the borrower has a down payment of 20% or more, depending on the borrower’s credit score and other factors.

Factors Influencing Mortgage Insurance Cost

Mortgage insurance premiums are calculated based on a variety of factors, including the borrower’s credit score, the loan-to-value ratio (LTV), and the type of mortgage. Understanding these factors can help borrowers make informed decisions about their mortgage financing.

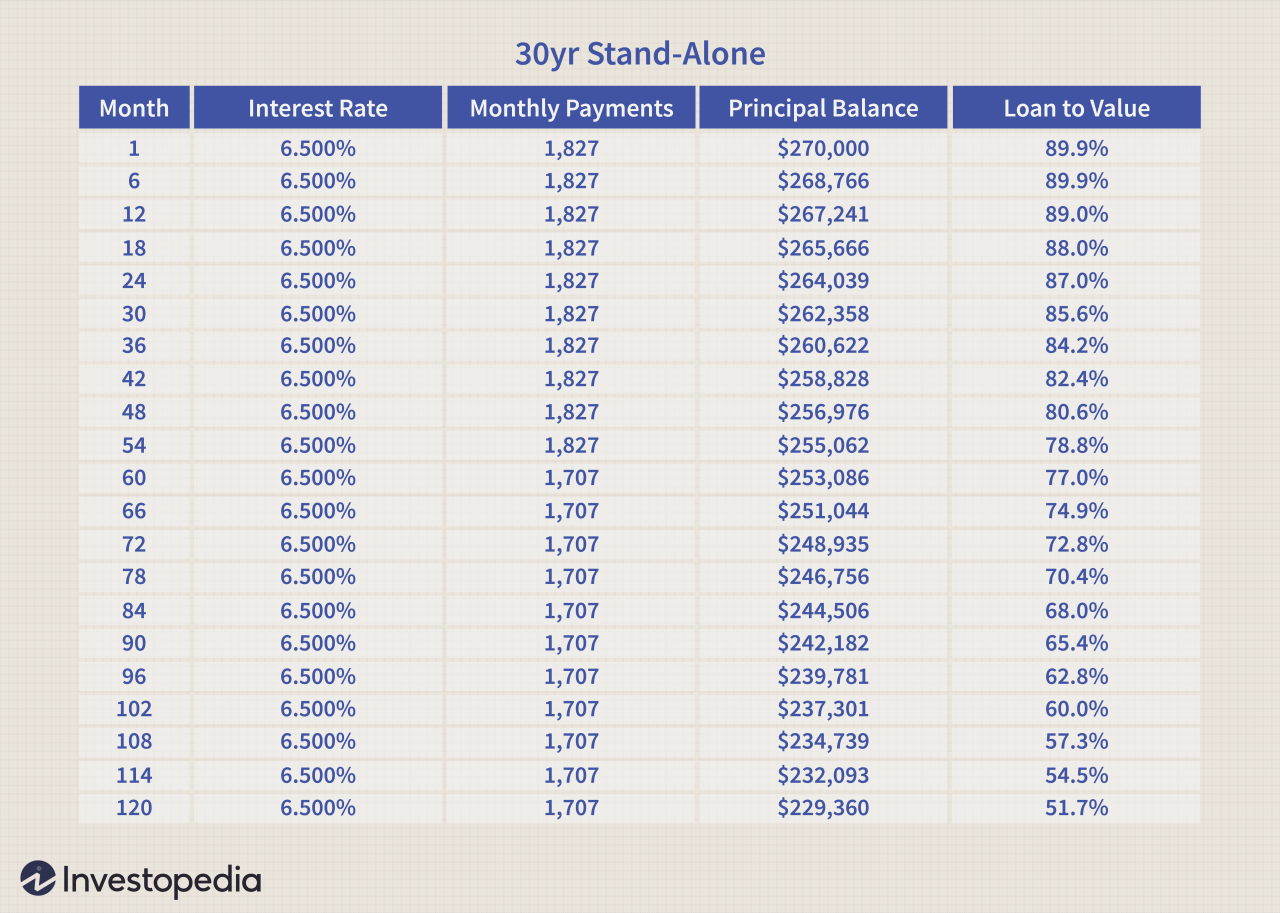

Loan-to-Value Ratio (LTV)

The loan-to-value ratio is a key factor in determining mortgage insurance premiums. It represents the amount of the mortgage loan compared to the value of the property. A higher LTV generally indicates a higher risk for the lender, leading to higher mortgage insurance premiums. For example, a borrower with an LTV of 80% will typically pay a higher premium than a borrower with an LTV of 70%.

The LTV is calculated as follows:

LTV = Loan Amount / Property Value

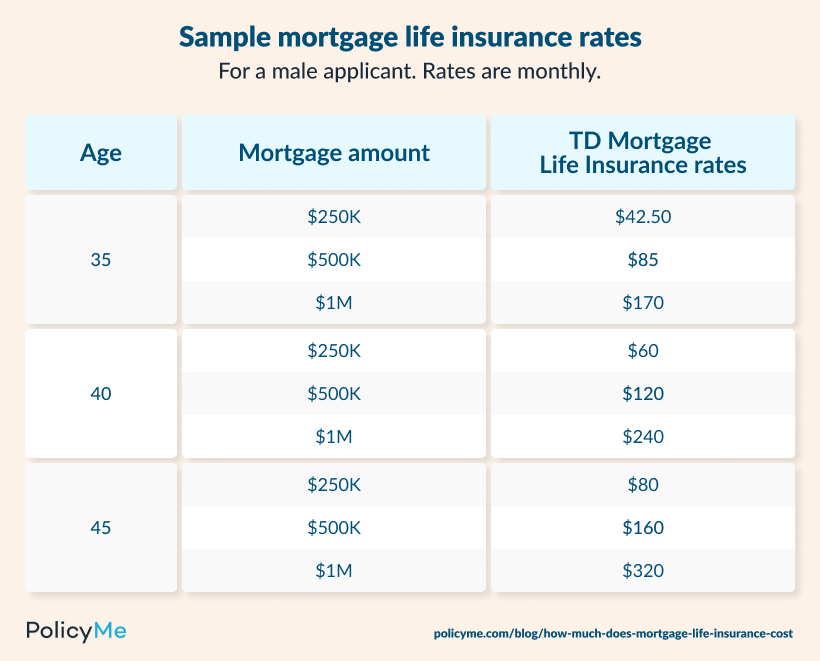

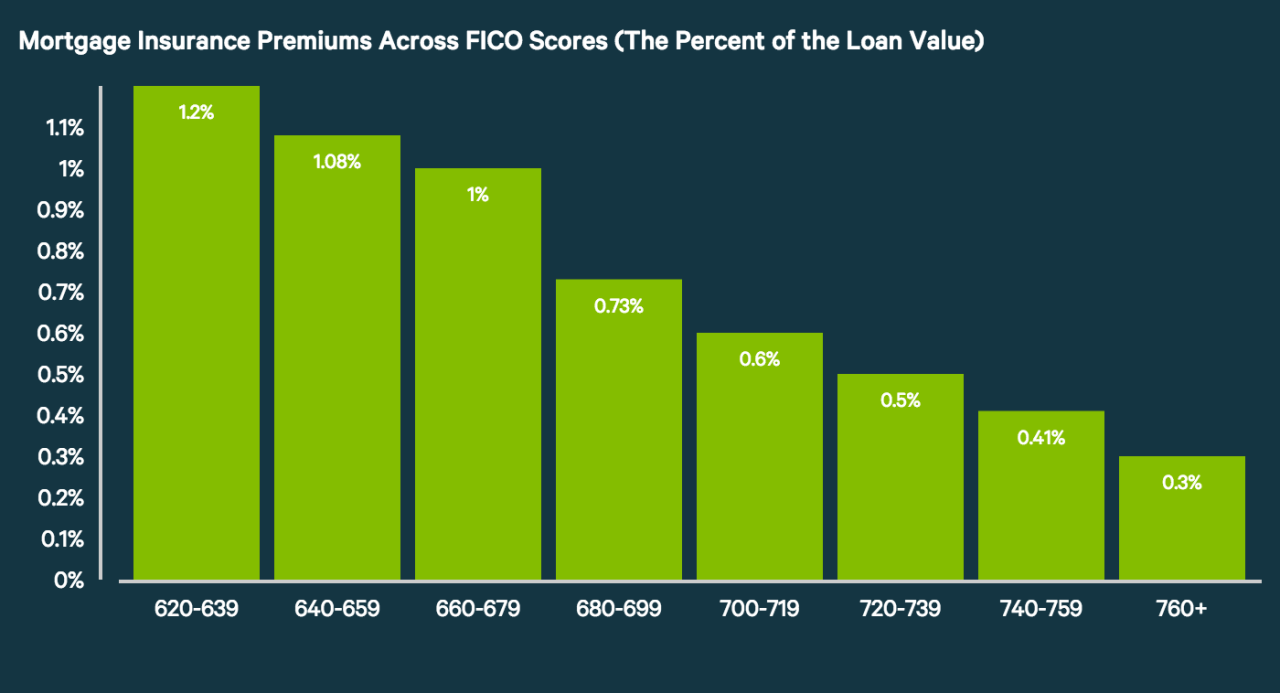

Credit Score

A borrower’s credit score is another significant factor influencing mortgage insurance premiums. A higher credit score generally indicates a lower risk for the lender, resulting in lower premiums. Borrowers with excellent credit scores can often qualify for lower mortgage insurance rates. Conversely, borrowers with lower credit scores may face higher premiums.

Type of Mortgage

The type of mortgage also plays a role in determining mortgage insurance costs. For example, Federal Housing Administration (FHA) loans typically require mortgage insurance, even for borrowers with good credit scores and low LTVs. Conventional loans, on the other hand, may not require mortgage insurance if the borrower has a sufficient down payment and a good credit score.

Calculating Mortgage Insurance Cost

Mortgage insurance premiums are calculated based on various factors, including the loan-to-value ratio (LTV), credit score, and the type of mortgage. Understanding these factors is crucial for determining the cost of mortgage insurance and making informed decisions.

Average Mortgage Insurance Premiums

The following table illustrates average mortgage insurance premiums based on different LTVs and credit scores:

| LTV (%) | Credit Score | Average Premium (%) |

|—|—|—|

| 80 | 740+ | 0.50 |

| 80 | 680-739 | 0.75 |

| 80 | 620-679 | 1.00 |

| 90 | 740+ | 1.00 |

| 90 | 680-739 | 1.25 |

| 90 | 620-679 | 1.50 |

| 95 | 740+ | 1.50 |

| 95 | 680-739 | 1.75 |

| 95 | 620-679 | 2.00 |

Note: These are just average premiums and actual costs may vary depending on other factors.

Calculating Annual Mortgage Insurance Cost

The annual cost of mortgage insurance can be calculated using the following formula:

Annual Mortgage Insurance Cost = (Loan Amount x Mortgage Insurance Premium) / 12

Example:

Let’s assume a loan amount of $200,000 and a mortgage insurance premium of 0.5%. The annual mortgage insurance cost would be:

($200,000 x 0.005) / 12 = $83.33 per month

Mortgage Insurance Premium Payment

Mortgage insurance premiums are typically paid monthly along with your mortgage payment. Some lenders may also offer the option of paying the premium upfront, which can result in a lower overall cost.

Benefits of Mortgage Insurance

Mortgage insurance, also known as PMI, offers significant benefits for both borrowers and lenders, making it a valuable tool in the mortgage market. It provides financial protection for both parties, especially in situations where borrowers may face financial challenges.

Protection for Borrowers

Mortgage insurance primarily protects borrowers by allowing them to secure a mortgage with a lower down payment. This is particularly advantageous for individuals who may not have accumulated enough savings for a substantial down payment. By reducing the required down payment, borrowers can access homeownership sooner, potentially building equity and wealth more rapidly.

- Reduced Down Payment Requirements: Mortgage insurance allows borrowers to qualify for a mortgage with a lower down payment, typically 3% to 5% of the purchase price, compared to the traditional 20% down payment requirement. This can make homeownership more accessible, especially for first-time buyers or those with limited savings.

- Improved Credit Score: Paying mortgage insurance premiums can demonstrate financial responsibility and contribute to a better credit score. A higher credit score can open doors to better interest rates and loan terms in the future.

- Peace of Mind: Mortgage insurance provides peace of mind, knowing that if unforeseen circumstances arise, such as job loss or illness, the lender is protected from potential losses. This can help alleviate financial stress and provide a safety net for borrowers.

Protection for Lenders

Mortgage insurance safeguards lenders against potential losses in case of borrower default. It compensates lenders for a portion of the outstanding loan balance, mitigating their risk and encouraging them to offer loans to borrowers with lower down payments. This practice helps expand access to credit and promotes broader homeownership.

- Reduced Risk: Mortgage insurance allows lenders to extend mortgages to borrowers with lower down payments, knowing that they are protected against potential losses. This reduces the lender’s risk and encourages them to offer loans to a wider range of borrowers.

- Increased Lending Opportunities: Mortgage insurance allows lenders to expand their lending opportunities, reaching borrowers who may not have been eligible for a mortgage without it. This helps increase homeownership rates and contribute to a more vibrant housing market.

- Stable Loan Portfolio: By mitigating the risk of borrower default, mortgage insurance helps lenders maintain a stable loan portfolio. This stability is crucial for lenders to manage their financial obligations and continue offering loans to borrowers.

Examples of Benefits

- First-Time Homebuyers: Mortgage insurance enables first-time homebuyers to enter the market sooner, building equity and wealth faster. It reduces the barrier to entry, making homeownership attainable for a wider range of individuals.

- Borrowers with Limited Savings: For borrowers with limited savings, mortgage insurance provides a pathway to homeownership. It allows them to qualify for a mortgage with a lower down payment, reducing the financial burden and making homeownership more achievable.

- Unforeseen Circumstances: In situations where borrowers face unexpected financial challenges, such as job loss or illness, mortgage insurance protects lenders and prevents them from incurring significant losses. This allows borrowers to avoid foreclosure and potentially retain their homes.

Alternatives to Mortgage Insurance

Mortgage insurance is a common requirement for borrowers with low down payments, but there are alternatives available. Understanding these alternatives can help you choose the best option for your situation.

Higher Down Payments

A higher down payment is the most straightforward way to avoid mortgage insurance altogether. By putting down a larger percentage of the purchase price, you reduce the loan amount, thereby lowering your risk to the lender. This eliminates the need for mortgage insurance.

For example, if you’re purchasing a $300,000 home, a 20% down payment ($60,000) would eliminate the need for mortgage insurance.

Private Mortgage Insurance (PMI)

Private mortgage insurance (PMI) is an alternative to traditional mortgage insurance offered by private companies. While it serves a similar purpose, it can be less expensive than traditional mortgage insurance. PMI is typically required when you have a loan-to-value ratio (LTV) of 80% or higher, meaning you’ve put down less than 20%.

- Cost: PMI premiums are usually calculated as a percentage of the outstanding loan amount. The cost can vary based on factors like your credit score, loan amount, and LTV.

- Benefits: PMI can be canceled once your LTV reaches 80%, typically when you’ve paid down 20% of the loan. This can save you money on your monthly mortgage payments.

Other Alternatives

Besides higher down payments and PMI, there are other alternatives to consider, such as:

- Government-backed loans: FHA and VA loans have lower down payment requirements and often don’t require mortgage insurance. However, they may have stricter eligibility requirements and loan limits.

- Seller financing: In some cases, the seller might be willing to finance a portion of the purchase price, potentially eliminating the need for mortgage insurance.

- Gifted funds: You may be able to use gifted funds from family or friends to increase your down payment, reducing the need for mortgage insurance.

Mortgage Insurance Cancellation

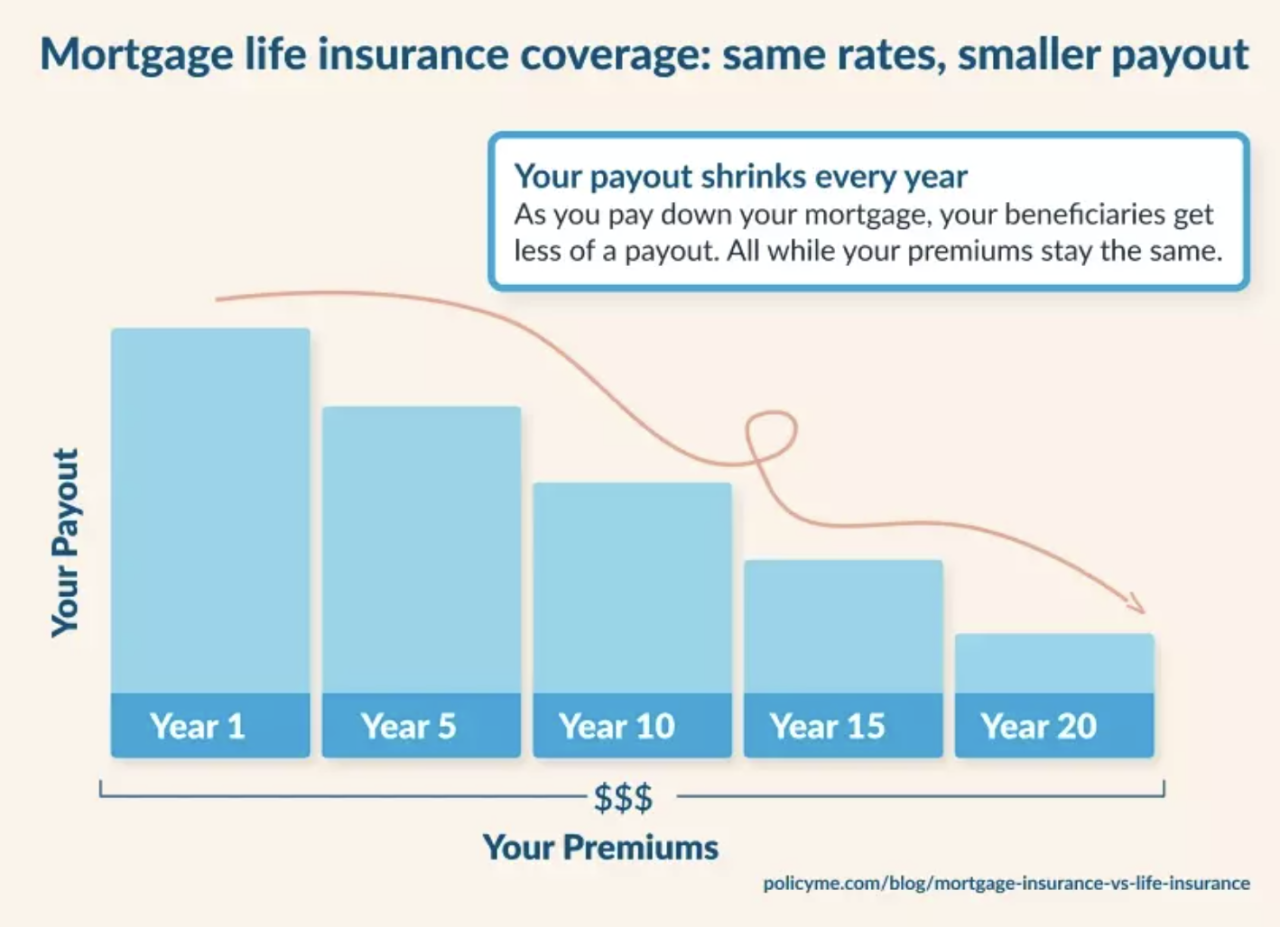

Mortgage insurance is typically designed to protect lenders against losses if borrowers default on their loans. However, in many cases, borrowers can cancel their mortgage insurance once they’ve built up enough equity in their homes.

Cancellation Process

The process for canceling mortgage insurance varies depending on the lender and the type of loan. However, in general, borrowers need to contact their lender to request cancellation. The lender will then review the borrower’s account to determine if they meet the cancellation criteria.

Cancellation Criteria

Mortgage insurance can be canceled when the loan-to-value (LTV) ratio reaches a certain threshold. This threshold is typically 80%, meaning that the borrower has at least 20% equity in their home.

Scenarios for Cancellation

There are several scenarios where mortgage insurance can be canceled.

- Reaching 80% LTV: As mentioned earlier, once the borrower’s equity reaches 20% of the home’s value, they can usually request cancellation.

- Refinancing: If the borrower refinances their mortgage to a lower LTV ratio, they may be able to cancel their mortgage insurance.

- Home Appreciation: If the value of the home increases significantly, the borrower’s equity will also increase, potentially reaching the 80% LTV threshold.

Mortgage Insurance and Refinancing

Refinancing your mortgage can be a smart financial move, but it can also impact your mortgage insurance obligations. Understanding how refinancing affects mortgage insurance is crucial for making informed decisions.

Impact of Mortgage Insurance on Refinancing Options

Mortgage insurance can limit your refinancing options, particularly if you’re looking to reduce your monthly payments or lower your interest rate. This is because lenders may require you to maintain mortgage insurance even after refinancing, especially if your loan-to-value (LTV) ratio remains above 80%.

The LTV ratio is calculated by dividing the outstanding mortgage balance by the current market value of the property.

For example, if you refinance a $200,000 mortgage with an LTV of 85% to a new mortgage with a lower interest rate, you might still be required to pay mortgage insurance. This is because your LTV remains above 80%.

How Refinancing Affects Mortgage Insurance Premiums

Refinancing can impact your mortgage insurance premiums in several ways:

* Lower Interest Rate: If you refinance to a lower interest rate, you might be able to reduce your monthly mortgage insurance premium. This is because you’ll be paying down your mortgage principal faster, reducing your LTV ratio.

* Increased Loan Amount: If you refinance to a higher loan amount, your LTV ratio will increase, potentially leading to higher mortgage insurance premiums.

* Changes in Loan Type: Switching from a fixed-rate mortgage to an adjustable-rate mortgage (ARM) or vice versa can affect your mortgage insurance premium. ARMs often have higher interest rates, which could increase your mortgage insurance cost.

* Refinancing to a Conventional Loan: If you refinance your FHA or VA loan to a conventional loan, you might be able to drop mortgage insurance if your LTV falls below 80%. However, some lenders may still require you to maintain mortgage insurance based on your credit score or other factors.

Managing Mortgage Insurance During a Refinance

Here are some tips for managing mortgage insurance during a refinance:

* Shop Around for Lenders: Compare offers from different lenders to find the best rates and terms. Some lenders may be more flexible with mortgage insurance requirements than others.

* Consider a Higher Down Payment: A larger down payment can help you avoid mortgage insurance altogether.

* Explore Refinancing Options: If you’re looking to refinance, explore options that allow you to drop mortgage insurance, such as refinancing to a conventional loan with an LTV below 80%.

* Negotiate with Your Lender: You might be able to negotiate with your lender to remove mortgage insurance if your LTV drops below 80% after refinancing.

Tips for Reducing Mortgage Insurance Cost

Mortgage insurance, while a necessary protection for lenders, can add a significant cost to your monthly mortgage payments. However, there are several strategies you can employ to minimize these premiums and potentially save thousands of dollars over the life of your loan.

Improving Credit Scores

A higher credit score can significantly reduce your mortgage insurance premiums. Lenders perceive borrowers with strong credit histories as less risky, making them more likely to repay their loans on time. This translates to lower premiums for mortgage insurance.

- Pay Bills on Time: Prompt payment of all your bills, including credit cards, utilities, and loans, is crucial for building a positive credit history. Late payments can negatively impact your credit score, potentially increasing your mortgage insurance cost.

- Keep Credit Utilization Low: Aim to keep your credit utilization ratio (the amount of credit you’re using compared to your total available credit) below 30%. A lower utilization ratio demonstrates responsible credit management and can improve your credit score.

- Monitor Your Credit Report: Regularly check your credit report for errors or fraudulent activity. Errors can negatively impact your score, so it’s essential to correct them promptly.

Maximizing Down Payments

One of the most effective ways to avoid mortgage insurance altogether is to make a larger down payment. The more you put down upfront, the less you need to borrow, reducing the risk for lenders and potentially eliminating the need for mortgage insurance.

- Save Consistently: Develop a disciplined savings plan to accumulate a substantial down payment. Consider automating your savings by setting up regular transfers from your checking account to a dedicated savings account.

- Explore Down Payment Assistance Programs: Some government agencies and non-profit organizations offer down payment assistance programs to help first-time homebuyers. Research these programs to see if you qualify.

- Consider Selling Assets: If you have valuable assets, such as stocks, bonds, or a second car, consider selling them to boost your down payment.

Other Strategies

Beyond credit scores and down payments, other strategies can help reduce your mortgage insurance costs.

- Shop Around for Lenders: Different lenders have varying mortgage insurance rates. Compare quotes from multiple lenders to find the most competitive rates.

- Negotiate with Your Lender: Some lenders may be willing to negotiate mortgage insurance rates, especially if you have a strong credit history and a substantial down payment.

- Consider a Shorter Loan Term: A shorter loan term, such as a 15-year mortgage, often results in lower interest rates and, consequently, lower mortgage insurance premiums.

Mortgage Insurance and the Housing Market

Mortgage insurance and the housing market are intricately intertwined, influencing each other in complex ways. The cost of mortgage insurance is directly impacted by fluctuations in home prices, and the availability and affordability of mortgage insurance can influence overall housing market trends.

Impact of Rising Home Prices on Mortgage Insurance Costs

Rising home prices can significantly impact mortgage insurance costs. As housing values increase, the amount of equity homeowners build up in their properties also grows. This increased equity reduces the risk for lenders, as they are less likely to experience significant losses in the event of a default. As a result, mortgage insurance premiums may decline or be canceled altogether as homeowners reach certain equity thresholds.

For example, if a home was purchased for $300,000 with a 20% down payment, the borrower would have $60,000 in equity. As the home’s value rises to $350,000, the borrower’s equity increases to $110,000. This increased equity could trigger a reduction in mortgage insurance premiums or even a complete cancellation of the insurance policy.

Impact of Mortgage Insurance Trends on the Housing Market

Mortgage insurance trends can have a ripple effect on the overall housing market. For instance, if mortgage insurance premiums are reduced or eliminated, it can make homeownership more accessible to borrowers with lower down payments. This can lead to increased demand for housing, potentially driving up home prices.

Conversely, if mortgage insurance premiums rise, it can make homeownership less affordable for some borrowers, particularly those with smaller down payments. This can dampen demand in the housing market, potentially slowing down price growth or even leading to price declines.

For example, a study by the National Association of Realtors found that borrowers with private mortgage insurance (PMI) were more likely to default on their mortgages than those without PMI. This suggests that PMI can increase the risk of foreclosure for some borrowers, potentially contributing to instability in the housing market.

Epilogue

Mortgage insurance, while often a necessary hurdle for borrowers, doesn’t have to be a financial burden. By understanding the factors that influence its cost and exploring strategies for minimizing its impact, you can navigate the complexities of homeownership with greater financial clarity. From maximizing down payments to improving your credit score, proactive measures can significantly reduce your mortgage insurance premiums, allowing you to achieve your homeownership dreams without sacrificing financial stability.