Navigating the world of renters insurance can feel like a maze, especially when trying to balance adequate coverage with affordability. The cost of renters insurance varies significantly, influenced by factors like location, coverage amount, and personal belongings. However, understanding the key drivers of cost and employing smart strategies can help you secure the protection you need without breaking the bank.

This comprehensive guide delves into the intricacies of renters insurance costs, providing insights into how premiums are calculated, tips for saving money, and essential information about coverage, exclusions, and claim processes. By understanding the ins and outs of renters insurance, you can make informed decisions and ensure you have the right policy to safeguard your belongings and financial well-being.

What is Renters Insurance?

Renters insurance is a type of property insurance that protects your personal belongings and provides liability coverage in case of unexpected events. It is essential for renters as it safeguards against financial losses resulting from incidents such as fire, theft, or natural disasters.

Types of Coverage

Renters insurance typically includes several types of coverage to protect your belongings and provide financial security.

- Personal Property Coverage: This coverage protects your personal belongings, such as furniture, electronics, clothing, and other valuables, against damage or loss due to covered perils like fire, theft, or vandalism. It usually includes a deductible, which is the amount you pay out of pocket before your insurance kicks in.

- Liability Coverage: This coverage protects you from financial responsibility if someone is injured or their property is damaged on your rental property. It provides legal defense and pays for medical expenses or property damage up to the policy limit.

- Additional Living Expenses (ALE): If your rental property becomes uninhabitable due to a covered event, this coverage helps pay for temporary housing and other living expenses until you can return to your home.

- Personal Liability Umbrella Coverage: This optional coverage provides additional liability protection beyond your renters insurance policy limit, offering broader financial protection against lawsuits.

Situations Where Renters Insurance is Beneficial

Renters insurance can provide valuable protection in various situations, including:

- Fire or Smoke Damage: A fire in your building or a neighboring unit could damage your belongings, requiring expensive repairs or replacements. Renters insurance would cover the cost of these losses.

- Theft: If your belongings are stolen, renters insurance can reimburse you for the value of the lost items. This coverage extends to theft both within and outside your apartment.

- Natural Disasters: Renters insurance can provide financial assistance in the event of natural disasters such as hurricanes, earthquakes, or floods, which can cause significant damage to your belongings.

- Liability Claims: If someone is injured on your property, even if it’s an accident, you could be held liable. Renters insurance provides legal defense and covers medical expenses or property damage up to the policy limit.

Factors Influencing Cost

The cost of renters insurance is influenced by several factors, making it crucial to understand how these elements can affect your premium. This knowledge empowers you to make informed decisions and potentially secure more affordable coverage.

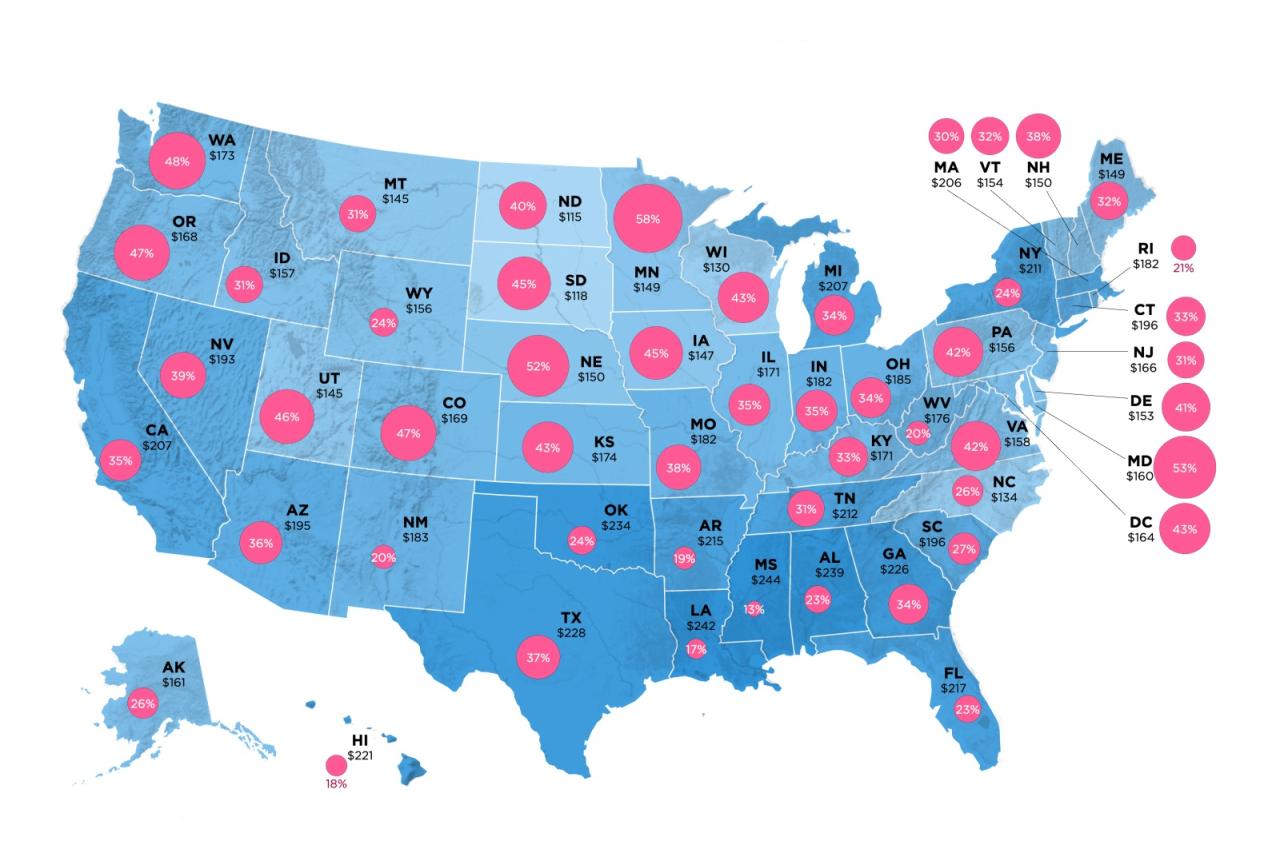

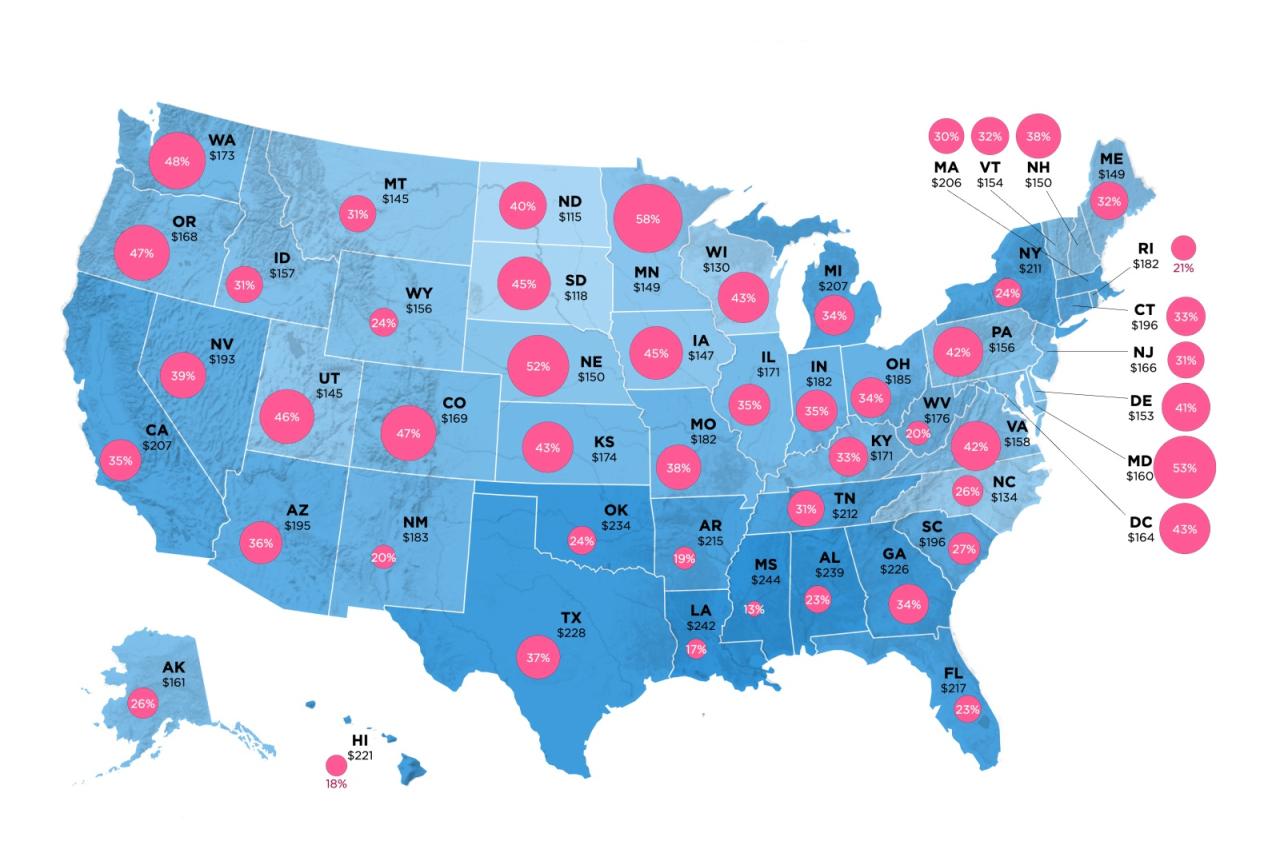

Location

The location of your rental property plays a significant role in determining your renters insurance premium. Factors such as crime rates, natural disaster risk, and the cost of living in the area all contribute to the cost of insurance.

- Higher crime rates typically lead to higher premiums, as insurance companies anticipate a greater likelihood of claims in these areas.

- Areas prone to natural disasters, such as hurricanes, earthquakes, or floods, also command higher premiums due to the increased risk of damage.

- Regions with a high cost of living often have higher insurance costs, reflecting the higher value of belongings and the potential for more substantial claims.

Coverage Amount

The amount of coverage you choose directly impacts your premium. Higher coverage limits, meaning greater financial protection for your belongings, result in higher premiums.

- Comprehensive coverage, which includes protection against a broader range of perils, typically comes at a higher cost than more limited coverage options.

- Higher coverage limits on specific items, such as expensive jewelry or electronics, can also increase your premium.

- It’s essential to strike a balance between adequate coverage and affordability. Consider the value of your belongings and the potential risks you face to determine the appropriate coverage level.

Personal Belongings

The value of your personal belongings is a key factor influencing your renters insurance premium.

- More valuable possessions, such as expensive electronics, jewelry, or artwork, will result in higher premiums.

- You may need to purchase additional coverage for specific high-value items, known as “scheduled personal property,” to ensure adequate protection.

- Maintain accurate inventories of your belongings, including their estimated value, to facilitate claims processing and potentially negotiate more favorable rates.

Deductibles

Your deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in.

- Higher deductibles typically result in lower premiums.

- Lower deductibles mean you pay less out of pocket in case of a claim, but they come with higher premiums.

- Consider your financial situation and risk tolerance when choosing a deductible. If you can comfortably afford a higher deductible, it could save you money on your premium.

Cost Comparison

Finding the best renters insurance policy involves more than just comparing prices. It’s crucial to understand what features are included in each policy and how they align with your specific needs. This section will guide you through comparing quotes from different providers, exploring average costs across various cities, and examining features and pricing from popular insurance companies.

Comparing Renters Insurance Quotes

Several online resources can help you compare renters insurance quotes from different providers. These platforms allow you to enter your information once and receive quotes from multiple insurers, making the process efficient and convenient. Here are some popular options:

- Insurance Comparison Websites: Sites like Policygenius, The Zebra, and Insurify provide a platform for comparing quotes from various insurance companies.

- Insurance Company Websites: Many insurance companies offer online quote tools on their websites, allowing you to get a personalized quote directly.

- Insurance Brokers: Brokers act as intermediaries, connecting you with multiple insurance companies and helping you find the best policy for your needs.

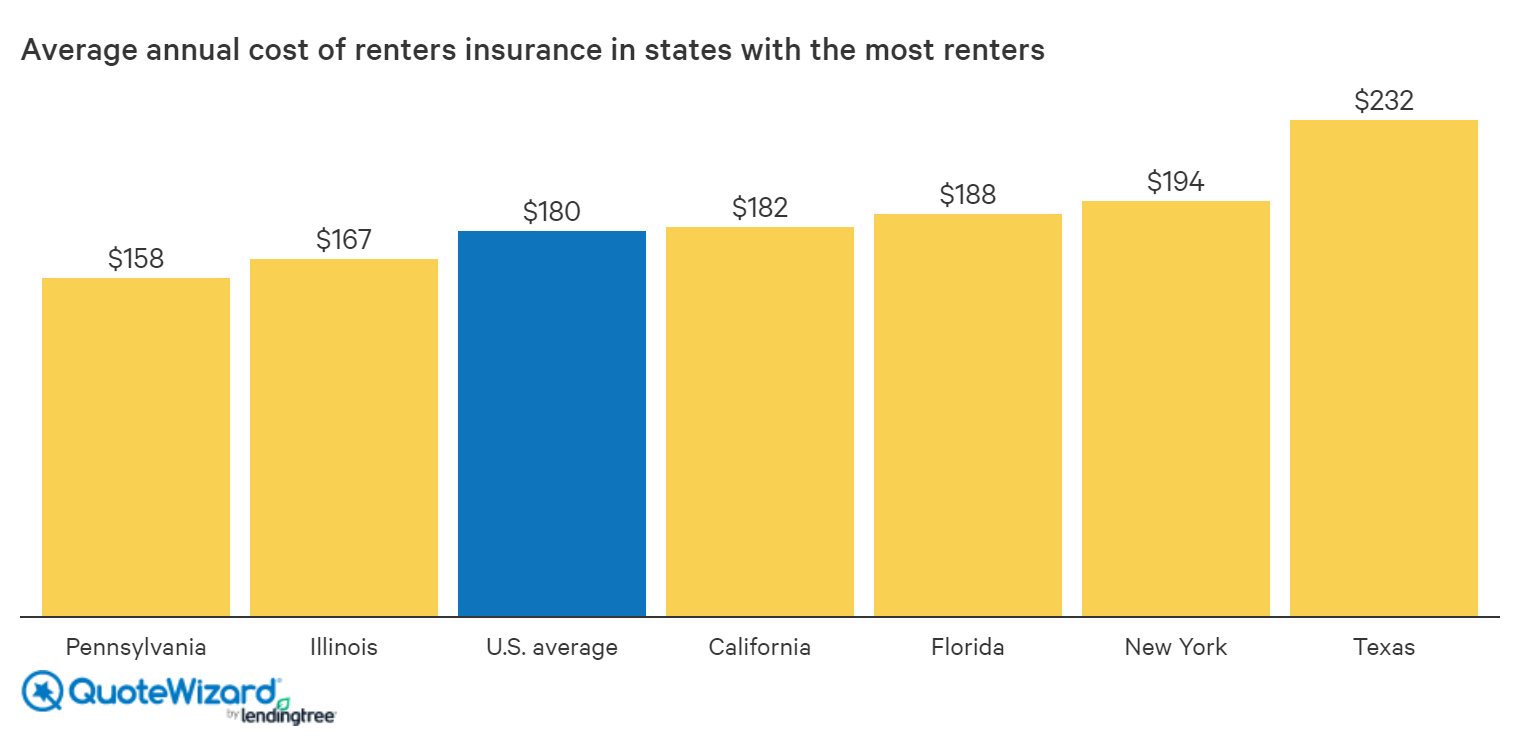

Average Renters Insurance Costs

The cost of renters insurance can vary significantly based on factors such as location, coverage limits, and the insurer’s risk assessment. Here’s a table showcasing the average cost of renters insurance in several major cities:

| City | Average Annual Cost |

|---|---|

| New York City | $250 – $350 |

| Los Angeles | $200 – $300 |

| Chicago | $150 – $250 |

| San Francisco | $300 – $400 |

| Houston | $100 – $200 |

It’s important to note that these are just average costs, and your actual premium may be higher or lower depending on your individual circumstances.

Popular Insurance Companies and Features

Several well-known insurance companies offer renters insurance policies. Here’s a comparison of some popular options, highlighting their features and pricing:

| Insurance Company | Key Features | Average Annual Cost |

|---|---|---|

| State Farm | – Comprehensive coverage options – Discounts for multiple policies – Strong customer service |

$150 – $250 |

| Allstate | – Flexible coverage options – 24/7 customer support – Online and mobile management tools |

$175 – $275 |

| Liberty Mutual | – High coverage limits available – Discounts for safety features – Strong financial stability |

$180 – $280 |

| USAA | – Exclusive for military members and families – Excellent customer service – Competitive pricing |

$125 – $225 |

| Geico | – Easy online quote process – 24/7 claims service – Discounts for bundling policies |

$130 – $230 |

Remember, these are just a few examples, and the best renters insurance company for you will depend on your individual needs and preferences.

Saving on Renters Insurance

Renters insurance offers vital protection for your belongings and liability, but you don’t have to pay an arm and a leg for it. Several strategies can help you save money on your renters insurance premiums without compromising coverage.

Raising Your Deductible

Increasing your deductible is a common way to lower your premium. The deductible is the amount you pay out-of-pocket before your insurance kicks in. A higher deductible means you pay more upfront in case of a claim, but your premium will be lower. Consider your financial situation and risk tolerance when deciding on a deductible. If you can comfortably afford a higher deductible, you’ll likely save on your premiums.

Bundling Policies

Many insurance companies offer discounts if you bundle your renters insurance with other policies, such as auto insurance or homeowners insurance. This is because insurers often provide discounts for multiple policies with the same company.

Discounts Available for Renters Insurance

- Safety Features: Installing security systems, smoke detectors, or fire extinguishers can qualify you for discounts.

- Payment Frequency: Paying your premium annually or semi-annually instead of monthly can sometimes result in a lower overall cost.

- Loyalty Discounts: Some insurance companies offer discounts to long-term customers who have been with them for a certain period.

- Good Credit Score: A good credit score can indicate financial responsibility and may lead to lower insurance premiums.

- Membership Discounts: Certain organizations, like alumni associations or professional groups, may offer discounts to their members.

Importance of Coverage

Renters insurance is more than just a financial safety net; it’s a crucial protection against the unexpected events that can disrupt your life and leave you financially vulnerable. While you may think you’re safe from significant risks as a renter, the reality is that various incidents can occur, from theft and fire to natural disasters and personal liability claims.

Financial Implications of Not Having Renters Insurance

The absence of renters insurance can have severe financial consequences, leaving you exposed to substantial out-of-pocket expenses. Here’s why:

Without renters insurance, you’re responsible for replacing your belongings if they’re stolen, damaged, or destroyed.

This means that if your apartment is burglarized, you’ll need to cover the cost of replacing your stolen items, which can be a substantial financial burden. Additionally, if a fire or other disaster damages your apartment, you’ll be responsible for the costs of temporary housing, repairs, and replacing your belongings. This could easily amount to thousands of dollars, leaving you with significant debt.

Real-Life Examples of Renters Insurance Support

- A renter in New York City had their apartment burglarized, and their renters insurance covered the cost of replacing their stolen electronics, furniture, and clothing. Without insurance, they would have been left with a hefty financial burden.

- A renter in California experienced a fire in their apartment building, and their renters insurance provided coverage for temporary housing, lost belongings, and repairs. They were able to recover quickly and minimize the financial impact of the disaster.

Common Exclusions

Renters insurance policies, while offering essential protection for your belongings, often come with specific exclusions that limit coverage. Understanding these limitations is crucial to avoid surprises when filing a claim. Here’s a breakdown of common exclusions to consider:

Events Not Covered

Exclusions in renters insurance policies are designed to protect insurance companies from covering events that are considered too risky or unpredictable. These events may include:

- Natural Disasters: Many policies exclude coverage for damage caused by earthquakes, floods, and landslides. These events are often unpredictable and can cause widespread devastation, making them challenging to insure. For example, a renter living in a coastal area might find their policy doesn’t cover damage caused by a hurricane.

- War and Terrorism: Renters insurance typically excludes coverage for damage caused by war, acts of terrorism, and nuclear incidents. These events are often beyond the control of individuals and can result in massive destruction, making them difficult to insure. For instance, a renter in a city targeted by a terrorist attack might not be covered for damages to their belongings.

- Neglect and Intentional Acts: Most policies exclude coverage for damage caused by negligence, such as leaving a window open during a storm or failing to maintain your property. Intentional acts, such as setting a fire or damaging your own belongings, are also typically excluded. For example, a renter who accidentally leaves a candle burning, causing a fire, might not be covered for the damages.

Excluded Property

Certain types of property are often excluded from renters insurance coverage. This may include:

- Valuables: Items like jewelry, artwork, and antiques may require additional coverage through a separate rider or endorsement. Standard renters insurance policies often have limits on the amount of coverage for such items. For example, a renter with a valuable collection of vintage watches might need to purchase additional coverage to ensure they’re fully protected.

- Cash and Securities: Renters insurance typically excludes coverage for large amounts of cash and securities kept in the home. For significant amounts, it’s advisable to consider a separate safe deposit box or other secure storage options. For instance, a renter keeping a large sum of cash at home for an upcoming purchase might not be covered for theft or loss.

- Pets: While some policies may offer limited liability coverage for pet-related incidents, they generally don’t cover the cost of replacing or treating a pet. Renters who own valuable pets may consider purchasing separate pet insurance. For example, a renter with a high-value dog might need pet insurance to cover veterinary expenses in case of an accident or illness.

Other Common Exclusions

- Business Property: Renters insurance typically excludes coverage for property used for business purposes. This includes equipment, inventory, and other items related to a home-based business. Renters operating a business from their home should consider purchasing separate business insurance. For example, a renter who operates a small online store from their apartment might need to purchase business insurance to cover their inventory and equipment.

- Gradual Damage: Damage caused by gradual deterioration, such as wear and tear, is generally not covered by renters insurance. For example, a renter whose furniture gradually fades due to sunlight exposure might not be covered for the damage.

Filing a Claim

Renters insurance claims are a crucial aspect of protecting your belongings and ensuring financial security in case of unforeseen events. Understanding the process of filing a claim, the necessary documentation, and the steps involved in resolving it with your insurance company is essential.

Documentation Required for a Claim

It is crucial to gather all the necessary documentation to support your renters insurance claim. This helps expedite the claim process and ensures a smooth resolution.

- Policy Information: This includes your policy number, effective dates, and contact information for your insurance company.

- Proof of Loss: This documentation proves the occurrence of the covered event, such as a police report for theft or a fire department report for a fire.

- Inventory of Damaged Items: A detailed list of damaged items, including descriptions, purchase dates, and receipts or proof of value. This helps determine the extent of the loss and calculate the compensation.

- Photos or Videos: Visual documentation of the damage can be helpful in demonstrating the extent of the loss and supporting your claim.

- Other Relevant Documents: Depending on the specific circumstances, additional documentation might be required, such as a medical report for personal injury claims or a contractor’s estimate for repair or replacement costs.

Steps Involved in Resolving a Claim

The process of resolving a renters insurance claim typically involves several steps:

- Reporting the Claim: Contact your insurance company immediately after the covered event occurs. They will provide instructions on how to report the claim, typically through a phone call, online portal, or mobile app.

- Claim Investigation: The insurance company will investigate the claim to verify the details and determine the extent of the loss. This may involve an adjuster visiting the property, reviewing documentation, and interviewing witnesses.

- Claim Evaluation: Based on the investigation, the insurance company will evaluate the claim and determine the amount of coverage available. They will consider factors such as the policy limits, deductibles, and the value of the damaged items.

- Claim Settlement: Once the claim is evaluated, the insurance company will make a settlement offer. This offer may be in the form of a payment for the replacement cost of the damaged items, or a payment for the actual cash value, which takes into account depreciation.

- Claim Resolution: If you agree to the settlement offer, the insurance company will issue a payment to you. If you disagree with the offer, you can appeal the decision or seek assistance from a public adjuster.

Renters Insurance and Liability

Renters insurance not only protects your belongings but also provides liability coverage, a crucial aspect often overlooked. This coverage safeguards you financially if you are held responsible for an accident or injury that occurs on your property.

Liability Coverage Explained

Liability coverage in renters insurance acts as a financial shield, protecting you from lawsuits or claims arising from accidents or injuries caused by you, your family members, or even your pets. It covers legal expenses, medical bills, and other related costs stemming from such incidents.

Importance of Liability Coverage

Liability coverage is paramount for renters as it safeguards them from significant financial losses arising from unforeseen incidents. Without this coverage, you could face substantial out-of-pocket expenses, potentially jeopardizing your financial stability.

Examples of Liability Coverage Benefits

- Guest Injury: If a visitor trips and falls on your property due to a loose floorboard, liability coverage would help cover medical bills and legal costs.

- Pet-Related Accidents: Your dog bites a neighbor’s child, causing injuries. Liability coverage would cover the medical expenses and potential legal settlements.

- Property Damage: You accidentally damage your neighbor’s property while moving furniture. Liability coverage would help compensate for the repairs.

Renters Insurance and Pets

Owning a pet can add joy and companionship to your life, but it can also present unique challenges when it comes to renters insurance. While renters insurance generally covers your personal property, it’s important to understand how pet-related incidents are addressed.

Pet Liability Coverage

Renters insurance policies typically include liability coverage, which protects you financially if your pet causes damage to someone else’s property or injures another person. For example, if your dog bites a neighbor’s child, your liability coverage would help pay for medical bills and legal expenses.

Pet Medical Coverage

Renters insurance doesn’t typically cover medical expenses for your pet. However, some policies may offer limited coverage for vet bills in the event of an accident or injury caused by a covered peril, such as a fire or theft.

Pet Damage Coverage

Renters insurance policies may also offer coverage for damage caused by your pet to your rented property. For example, if your dog chews on the baseboards or scratches the floor, your policy might cover the cost of repairs. However, most policies have limits on the amount of coverage for pet damage, and some may exclude certain types of damage altogether. It’s important to carefully review your policy to understand what is and isn’t covered.

The Importance of Pet Insurance

While renters insurance can provide some protection for pet-related incidents, it’s not a substitute for pet insurance. Pet insurance is a specialized type of insurance that covers veterinary expenses for your pet, such as illnesses, injuries, and accidents.

How Pet Insurance Can Protect Renters

Pet insurance can protect renters from financial hardship by helping to pay for unexpected veterinary bills. For example, if your pet needs emergency surgery or has a chronic health condition, pet insurance can help cover the cost of treatment.

Renters Insurance and Personal Belongings

Renters insurance is designed to protect your personal belongings in case of damage or loss. Your possessions are your responsibility, and it is crucial to understand how renters insurance can safeguard them from various perils.

Determining the Value of Personal Belongings

Estimating the value of your personal belongings is essential to ensure you have adequate coverage. If you underinsure, you may not receive enough compensation to replace your belongings in the event of a loss.

- Inventory Your Belongings: Create a detailed list of your belongings, including descriptions, purchase dates, and estimated replacement costs. Consider taking photographs or videos of each item. This detailed inventory serves as evidence of ownership and value when filing a claim.

- Use Replacement Cost Coverage: This type of coverage pays for the actual cost of replacing your damaged or stolen items with new, similar items. It is usually more expensive than actual cash value (ACV) coverage, which pays for the depreciated value of your belongings.

- Consider Additional Coverage: Some renters insurance policies offer additional coverage for specific items, such as jewelry, artwork, or collectibles. You may need to purchase separate coverage for valuable items exceeding the standard policy limits.

Protecting and Documenting Valuable Possessions

It’s crucial to take proactive measures to protect your valuables and document their existence for insurance purposes.

- Safeguard Valuable Items: Store valuable items like jewelry, artwork, and electronics in a safe deposit box or a secure location within your home. Consider using a home security system to deter theft.

- Document Valuable Items: Maintain detailed records of your valuable items, including purchase receipts, appraisals, and photographs. This documentation will help support your claim if an item is lost or damaged.

- Consider a Personal Property Floater: If you have a collection of valuable items, consider purchasing a personal property floater. This provides additional coverage for specific items that may exceed the limits of your standard renters insurance policy.

Summary

Renters insurance offers a vital safety net against unforeseen events, protecting your belongings and providing liability coverage. While cost is a significant consideration, it’s crucial to prioritize adequate coverage to mitigate potential financial hardship. By understanding the factors influencing cost, exploring savings strategies, and comparing quotes from different providers, you can find a renters insurance policy that aligns with your needs and budget. Remember, peace of mind is priceless, and renters insurance provides just that, allowing you to focus on enjoying your rental property without the burden of excessive financial risks.