Imagine setting off on a year-long adventure, exploring new cultures and breathtaking landscapes, knowing you’re protected no matter what. This is the promise of a travel insurance annual plan – a safety net for the intrepid traveler. Unlike single-trip policies, annual plans provide continuous coverage for multiple trips throughout the year, offering peace of mind and financial security for those who live for the journey.

Whether you’re a seasoned globetrotter or a first-time adventurer, understanding the benefits and intricacies of annual travel insurance is crucial. This guide will demystify the process, exploring everything from the basics of coverage to choosing the right plan for your needs. We’ll delve into the advantages of annual plans, discuss key considerations, and provide expert tips for maximizing your travel insurance experience.

What is Travel Insurance?

Travel insurance is a type of insurance that protects travelers against unexpected events that may occur during their trip, such as medical emergencies, flight delays, lost luggage, or trip cancellations. It provides financial protection and peace of mind, allowing travelers to focus on enjoying their journey without worrying about unforeseen expenses.

Types of Travel Insurance Coverage

Travel insurance policies typically offer a range of coverage options, tailored to different needs and travel styles. These coverages can be categorized into various types, each addressing specific risks and providing financial support in case of unexpected events.

- Medical Expenses: This coverage pays for medical expenses incurred due to illness or injury while traveling, including hospitalization, surgery, and emergency medical evacuation.

- Trip Cancellation and Interruption: This coverage reimburses travelers for non-refundable trip expenses if they need to cancel or interrupt their trip due to unforeseen circumstances such as illness, injury, or family emergencies.

- Lost or Delayed Luggage: This coverage provides compensation for lost or delayed luggage, covering the cost of replacing essential items or reimbursing for the inconvenience caused by the delay.

- Emergency Evacuation and Repatriation: This coverage covers the cost of medical evacuation or repatriation if a traveler requires urgent medical attention or needs to be transported back home due to a medical emergency.

- Personal Liability: This coverage protects travelers against legal liability for accidental damage or injury caused to others while traveling.

- Travel Delay: This coverage provides compensation for expenses incurred due to travel delays, such as meals, accommodation, and transportation, caused by factors like flight cancellations or weather disruptions.

Benefits of Having Travel Insurance

Having travel insurance offers several benefits, providing travelers with financial protection and peace of mind during their journeys. These benefits can be categorized into various aspects, each highlighting the value of having travel insurance.

- Financial Protection: Travel insurance safeguards travelers against unexpected expenses, such as medical bills, flight cancellations, or lost luggage, ensuring that they are not burdened with significant financial losses.

- Peace of Mind: Knowing that they have travel insurance provides travelers with peace of mind, allowing them to focus on enjoying their trip without worrying about unforeseen events and their potential financial consequences.

- Access to Emergency Assistance: Travel insurance policies often include access to 24/7 emergency assistance services, providing travelers with support and guidance in case of emergencies or unexpected situations.

- Protection Against Unexpected Events: Travel insurance covers a wide range of unexpected events, including illness, injury, flight delays, lost luggage, and trip cancellations, ensuring that travelers are financially protected and can manage unforeseen situations effectively.

Annual Travel Insurance Plans

Annual travel insurance plans provide coverage for multiple trips taken within a year. These plans are ideal for frequent travelers who need comprehensive protection throughout the year.

Coverage Provided by Annual Plans

Annual travel insurance plans offer a range of coverage options, including:

- Medical expenses: This covers medical costs incurred during your trip, including emergency medical evacuation and hospitalization.

- Trip cancellation and interruption: This protects you against financial losses if you have to cancel or interrupt your trip due to unforeseen circumstances, such as illness, injury, or natural disasters.

- Baggage loss and damage: This covers the cost of replacing or repairing lost or damaged luggage.

- Personal liability: This protects you against legal claims arising from accidents or injuries caused to others during your trip.

- Emergency assistance: This provides 24/7 access to emergency assistance services, including medical referrals, legal advice, and translation services.

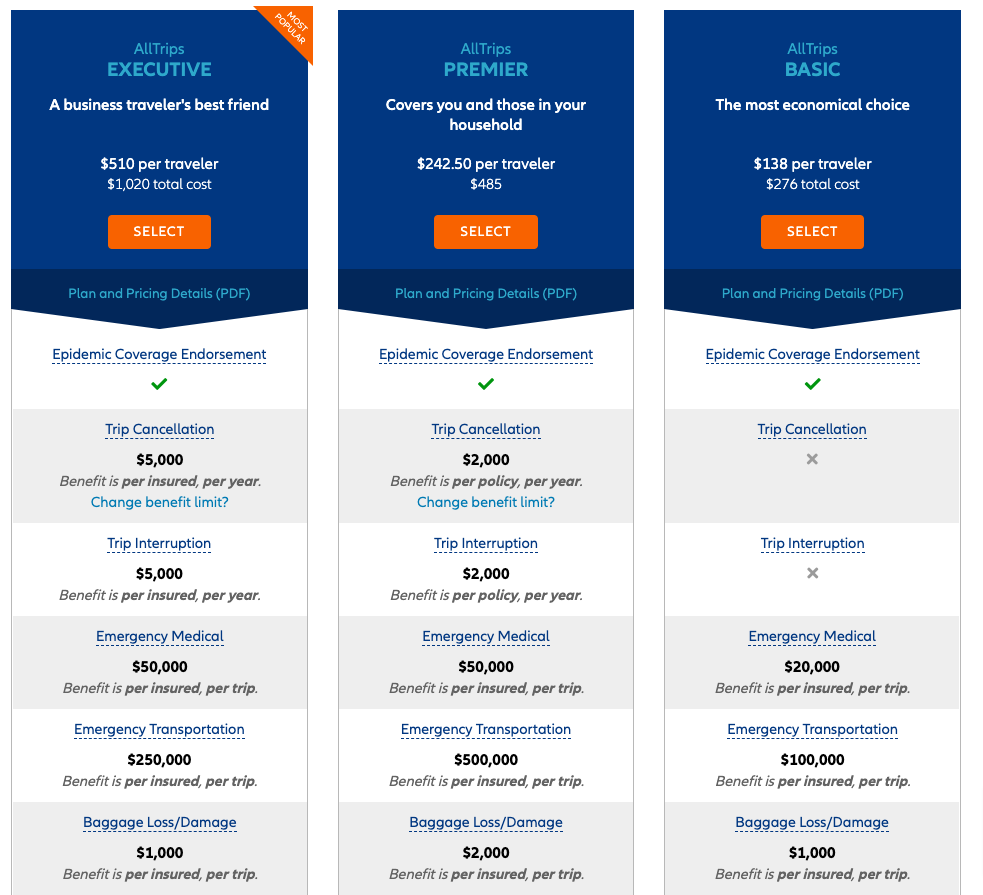

Comparing Annual Plans to Single-Trip Insurance

Annual travel insurance plans differ from single-trip insurance in several key ways:

- Coverage duration: Annual plans provide coverage for a full year, while single-trip plans only cover a specific trip.

- Cost: Annual plans are typically more expensive than single-trip plans, but they can be more cost-effective if you travel frequently.

- Flexibility: Annual plans offer greater flexibility, as you can use them for multiple trips without having to purchase separate insurance for each trip.

Benefits of Annual Travel Insurance

For frequent travelers, an annual travel insurance plan offers numerous advantages over single-trip policies, providing comprehensive coverage and peace of mind throughout the year.

Cost Savings for Frequent Travelers

Annual travel insurance plans are generally more cost-effective than purchasing individual policies for each trip, especially for travelers who take multiple vacations or business trips throughout the year. By paying a single premium upfront, you can enjoy coverage for all your journeys within a specific timeframe, potentially saving money in the long run.

For instance, a traveler who takes four international trips annually might find that purchasing individual policies for each trip would cost significantly more than an annual plan, especially if they include extensive coverage options.

Comprehensive Coverage for Diverse Travel Needs

Annual travel insurance plans typically offer a wide range of coverage options, catering to various travel needs and scenarios. This comprehensive protection can include:

- Medical Expenses: Coverage for medical emergencies, hospitalizations, and medical evacuations.

- Trip Cancellation and Interruption: Protection against unexpected events that force you to cancel or interrupt your trip, such as illness, accidents, or family emergencies.

- Baggage Loss or Damage: Reimbursement for lost, stolen, or damaged luggage.

- Personal Liability: Coverage for legal expenses and damages caused to others.

- Emergency Assistance Services: 24/7 access to emergency assistance, including medical referrals, travel assistance, and legal support.

Peace of Mind and Flexibility

Having annual travel insurance provides peace of mind, knowing you are protected throughout the year, regardless of the number of trips you take. This allows you to travel with greater confidence and flexibility, as you are covered for unexpected events, even if you decide to take spontaneous trips.

For example, if you have an annual plan and decide to extend your vacation or embark on an unplanned adventure, you will be covered without having to purchase additional insurance.

Key Considerations for Choosing an Annual Plan

Choosing the right annual travel insurance plan requires careful consideration of several factors to ensure adequate coverage for your specific needs and travel habits. Factors such as your travel destinations, frequency of travel, and health conditions play a significant role in determining the most suitable plan.

Coverage Limits and Deductibles

Coverage limits and deductibles are crucial aspects of any insurance policy, including travel insurance. Coverage limits define the maximum amount the insurer will pay for a specific covered event, such as medical expenses or lost luggage. Deductibles represent the amount you pay out of pocket before the insurance coverage kicks in.

- Higher coverage limits generally come with higher premiums, but offer greater financial protection in case of unexpected events.

- Lower deductibles mean you pay less out of pocket, but result in higher premiums.

It is essential to strike a balance between coverage limits and deductibles that align with your budget and risk tolerance.

For example, if you are planning a trip to a remote destination with limited medical facilities, opting for higher medical expense coverage limits might be wise.

Pre-Existing Conditions and Exclusions

Pre-existing conditions and exclusions are important factors to consider when selecting an annual travel insurance plan. Pre-existing conditions refer to medical conditions you have before purchasing the insurance, while exclusions are specific events or circumstances not covered by the policy.

- Pre-existing conditions can significantly impact coverage, as insurers may exclude or limit coverage for related medical expenses.

- Exclusions can include, but are not limited to, adventure sports, extreme activities, and certain types of medical conditions.

It is crucial to carefully review the policy document to understand the coverage for pre-existing conditions and exclusions, and consider seeking additional coverage if needed.

Common Travel Insurance Coverage

Travel insurance policies typically offer a range of coverage options designed to protect travelers from unexpected events that may disrupt their trips. These policies are designed to mitigate financial losses and provide peace of mind while exploring the world.

Medical Expenses

Medical expenses are one of the most crucial aspects of travel insurance. These policies cover medical costs incurred during a trip due to illness, injury, or accidents. The coverage usually includes hospitalization, surgery, emergency medical transportation, and prescription drugs.

Medical expenses covered under travel insurance can significantly reduce the financial burden of unexpected medical events during your trip.

Emergency Evacuation

Emergency evacuation coverage is essential for travelers venturing to remote or medically underserved areas. This coverage assists in transporting travelers to a suitable medical facility or returning them home in case of a medical emergency.

Emergency evacuation coverage is particularly important for travelers who are traveling to remote areas, or who have pre-existing medical conditions.

Baggage Loss

Baggage loss coverage provides financial protection against the loss or damage of personal belongings during a trip. This coverage typically reimburses travelers for the cost of replacing lost or damaged items, up to a specified limit.

Travelers should be aware that baggage loss coverage may have specific exclusions, such as items of high value or perishable goods.

Trip Cancellation and Interruption

Trip cancellation and interruption coverage protect travelers against financial losses incurred when a trip is canceled or interrupted due to unforeseen circumstances.

Trip Cancellation

Trip cancellation coverage reimburses travelers for non-refundable trip expenses, such as airline tickets, hotel reservations, and tour bookings, if the trip is canceled due to covered reasons. Common covered reasons include illness, injury, death of a family member, or natural disasters.

Trip cancellation coverage can be a valuable safety net for travelers who have invested significant funds in their trip.

Trip Interruption

Trip interruption coverage provides financial assistance if a trip is unexpectedly interrupted due to a covered event. This coverage can help travelers cover additional expenses, such as travel costs to return home, lodging, and meals, if they need to cut their trip short.

Trip interruption coverage can help travelers avoid substantial financial losses if their trip is interrupted due to unforeseen circumstances.

How to Choose the Right Annual Plan

Choosing the right annual travel insurance plan is crucial to ensure you’re adequately protected during your travels. The process involves considering your travel needs, comparing different providers and plans, and making an informed decision. This guide will help you navigate the process and select the most suitable plan for your requirements.

Evaluating Your Travel Needs

Before diving into the specifics of plans and providers, it’s essential to assess your individual travel needs. This step involves understanding your travel patterns, destinations, and risk tolerance. For example, frequent travelers who venture to diverse locations may require more comprehensive coverage than someone taking a single trip to a nearby country.

- Travel Frequency: Consider how often you travel and the duration of your trips. Frequent travelers or those who embark on extended journeys may benefit from annual coverage.

- Destinations: Evaluate the destinations you plan to visit. Certain regions might pose specific risks, requiring specialized coverage like medical evacuation or political unrest protection.

- Activities: Factor in the activities you’ll be engaging in during your trips. Adventurous pursuits like skiing or scuba diving may require additional coverage.

- Risk Tolerance: Determine your level of risk tolerance. Individuals with a higher risk tolerance may opt for a plan with a lower deductible, while those with a lower risk tolerance may choose a plan with a higher deductible but lower premium.

Comparing Providers and Plans

Once you’ve identified your travel needs, it’s time to compare different providers and their offerings. The market offers a wide array of annual travel insurance plans, each with its own set of benefits, coverage, and premiums.

- Coverage: Compare the coverage offered by different providers, including medical expenses, trip cancellation, lost baggage, and emergency evacuation.

- Premiums: Assess the premium costs for each plan. Factors like age, destination, and coverage level influence premium pricing.

- Deductibles: Consider the deductible amount, which is the amount you pay out-of-pocket before the insurance kicks in. Higher deductibles typically result in lower premiums.

- Customer Service: Evaluate the provider’s customer service reputation and availability.

Tips for Getting the Best Value

To maximize your value, consider the following tips:

- Bundle Coverage: Explore options for bundling travel insurance with other insurance products, such as health insurance or home insurance, for potential discounts.

- Shop Around: Compare quotes from multiple providers to find the best deal. Online comparison tools can simplify this process.

- Consider Exclusions: Pay attention to any exclusions in the policy. Some plans may exclude specific activities, destinations, or medical conditions.

- Read the Fine Print: Thoroughly review the policy document to understand the terms and conditions, including coverage limitations and exclusions.

Frequently Asked Questions (FAQs)

Annual travel insurance is a valuable investment for frequent travelers, offering peace of mind and financial protection against unexpected events. However, navigating the intricacies of this insurance can leave some with unanswered questions. To clarify common concerns and provide a comprehensive understanding of annual travel insurance, we’ve compiled a list of frequently asked questions and their detailed answers.

Coverage for Pre-Existing Conditions

This section explores the coverage offered for pre-existing medical conditions.

- Pre-existing conditions can pose a challenge when seeking travel insurance, as they may not be covered under standard plans. It’s crucial to understand how pre-existing conditions are handled by different insurers.

- Some insurers may exclude coverage for pre-existing conditions entirely, while others may offer limited coverage, subject to specific conditions.

- It’s vital to disclose any pre-existing conditions to the insurer during the application process to ensure you receive the appropriate coverage.

- Failing to disclose pre-existing conditions can result in your claim being denied, leaving you financially responsible for unexpected medical expenses.

Coverage for Extreme Sports and Activities

This section discusses the coverage for activities that may be considered extreme.

- Annual travel insurance plans often have limitations or exclusions for extreme sports and activities, such as skydiving, scuba diving, or mountain climbing.

- These activities are considered high-risk and can increase the likelihood of accidents or injuries, which insurers may not cover.

- If you plan to engage in extreme sports or activities, it’s essential to check the policy’s specific coverage details to determine if these activities are covered or require additional coverage.

- Many insurers offer optional add-ons or endorsements that can extend coverage to include extreme sports, but these may come with additional premiums.

Coverage for Travel Delays and Cancellations

This section examines the coverage for travel delays and cancellations.

- Travel insurance plans typically provide coverage for travel delays and cancellations due to unforeseen circumstances, such as weather disruptions, mechanical failures, or medical emergencies.

- However, coverage for delays and cancellations may be subject to specific limitations, such as the duration of the delay, the reason for the cancellation, or the amount of reimbursement.

- It’s essential to review the policy’s coverage details to understand the specific circumstances under which you can claim for delays and cancellations.

- For instance, coverage for delays may be limited to a certain number of hours, and coverage for cancellations may be subject to certain exceptions, such as cancellations due to personal reasons.

Coverage for Lost or Stolen Luggage

This section explores the coverage for lost or stolen luggage.

- Annual travel insurance plans typically offer coverage for lost or stolen luggage, providing financial protection against the loss of personal belongings during your travels.

- However, the amount of coverage for lost or stolen luggage may be limited, and there may be deductibles or other limitations to consider.

- It’s essential to review the policy’s coverage details to understand the specific terms and conditions related to lost or stolen luggage coverage.

- For example, some insurers may limit coverage to a specific amount per item or per bag, and there may be a deductible you’ll need to pay before the insurer covers the remaining cost.

Coverage for Medical Expenses

This section delves into the coverage for medical expenses incurred during your travels.

- Annual travel insurance plans typically offer coverage for medical expenses incurred during your travels, including hospitalization, emergency medical treatment, and evacuation.

- However, coverage for medical expenses may be subject to specific limitations, such as the maximum amount covered, the types of medical services covered, or the geographical coverage area.

- It’s essential to review the policy’s coverage details to understand the specific terms and conditions related to medical expense coverage.

- For instance, some insurers may limit coverage to a certain amount per incident or per trip, and there may be a deductible you’ll need to pay before the insurer covers the remaining cost.

Coverage for Emergency Evacuation

This section examines the coverage for emergency evacuation.

- Annual travel insurance plans typically offer coverage for emergency evacuation, providing financial protection if you need to be transported back home due to a medical emergency or other unforeseen circumstances.

- However, coverage for emergency evacuation may be subject to specific limitations, such as the maximum amount covered, the types of emergencies covered, or the geographical coverage area.

- It’s essential to review the policy’s coverage details to understand the specific terms and conditions related to emergency evacuation coverage.

- For instance, some insurers may limit coverage to a certain amount per incident or per trip, and there may be a deductible you’ll need to pay before the insurer covers the remaining cost.

Coverage for Personal Liability

This section discusses the coverage for personal liability.

- Annual travel insurance plans may offer coverage for personal liability, providing financial protection if you are held legally responsible for causing injury or damage to another person or property while traveling.

- However, coverage for personal liability may be subject to specific limitations, such as the maximum amount covered, the types of incidents covered, or the geographical coverage area.

- It’s essential to review the policy’s coverage details to understand the specific terms and conditions related to personal liability coverage.

- For instance, some insurers may limit coverage to a certain amount per incident or per trip, and there may be a deductible you’ll need to pay before the insurer covers the remaining cost.

Case Studies

Travel insurance can seem like an unnecessary expense, but real-life stories demonstrate its value. Annual plans provide peace of mind and financial protection when unexpected events occur during your travels.

Medical Emergencies

- A young woman traveling in Southeast Asia was hospitalized with a severe case of food poisoning. Her annual travel insurance covered the cost of her medical treatment, including hospitalization, medication, and air ambulance transport back to her home country.

- An elderly couple on a European cruise suffered a heart attack while on shore. Their annual travel insurance covered the cost of their emergency medical care, including the repatriation of their remains back to their home country.

Trip Interruptions

- A family traveling to the Caribbean had their flight canceled due to a hurricane. Their annual travel insurance covered the cost of their accommodation, meals, and rebooking fees.

- A business traveler had to return home early due to a family emergency. Their annual travel insurance covered the cost of their non-refundable flights and accommodation.

Lost or Stolen Luggage

- A backpacker’s luggage was stolen from a hostel in South America. Their annual travel insurance covered the cost of replacing their belongings, including clothing, electronics, and toiletries.

- A family’s luggage was delayed in transit, arriving at their destination several days after they did. Their annual travel insurance covered the cost of purchasing essential items, such as clothing and toiletries.

Trip Cancellations

- A woman had to cancel her trip to Europe due to a sudden illness. Her annual travel insurance covered the cost of her non-refundable flights, accommodation, and tours.

- A couple had to cancel their honeymoon due to a natural disaster in their destination country. Their annual travel insurance covered the cost of their non-refundable flights, accommodation, and honeymoon activities.

Travel Insurance Tips and Recommendations

Travel insurance can be a valuable investment, especially when traveling internationally. It can provide financial protection against unexpected events, such as medical emergencies, trip cancellations, and lost luggage.

Maximizing Travel Insurance Benefits

To maximize the benefits of travel insurance, it’s crucial to understand the policy’s terms and conditions. Carefully review the coverage details, including exclusions and limitations.

- Choose the right plan: Ensure your policy aligns with your travel needs and budget. Consider factors like trip duration, destination, and activity level.

- Understand the claim process: Familiarize yourself with the claim process, including required documentation and deadlines. This will help you navigate any unforeseen situations smoothly.

- Keep records: Maintain receipts, itineraries, and other relevant documents to support your claims. This will facilitate a faster and more efficient claim process.

- Communicate with your insurer: Contact your insurer immediately in case of an emergency. This allows them to provide timely assistance and support.

Recommendations for Specific Situations and Destinations

Travel insurance recommendations vary based on the specific circumstances and destinations.

- Adventure travel: If you plan for adventure activities like hiking, skiing, or scuba diving, ensure your policy covers these activities. This is particularly important in destinations with higher risk factors.

- Medical emergencies: For travel to destinations with limited medical facilities or high healthcare costs, consider purchasing a plan with extensive medical coverage. This can protect you from significant financial burdens.

- Pre-existing conditions: If you have pre-existing medical conditions, disclose them to your insurer before purchasing a policy. This will ensure your coverage is adequate and avoid any potential claim denials.

Travel Safety Resources and Information

Staying informed about travel safety is essential for a smooth and enjoyable journey.

- Government travel advisories: Check government travel advisories for your destination, as they provide valuable information about safety risks and recommendations. For example, the U.S. Department of State offers travel advisories for various countries, which can be accessed on their website.

- Embassy and consulate websites: Visit the websites of your country’s embassy or consulate in your destination country. These websites often provide information on local laws, customs, and emergency contacts.

- Travel safety organizations: Consult travel safety organizations like the International SOS or the World Health Organization (WHO) for comprehensive safety information and resources. They offer advice on various aspects of travel safety, including health, security, and emergency preparedness.

The Future of Travel Insurance

The travel insurance industry is constantly evolving, driven by changing consumer needs, technological advancements, and global events. Understanding these emerging trends is crucial for both insurers and travelers to adapt and thrive in the future.

Impact of Technology on the Travel Insurance Industry

Technology is playing a transformative role in the travel insurance industry, streamlining processes, enhancing customer experiences, and creating new opportunities.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML are being used to personalize insurance offerings, automate underwriting, and detect fraud. For example, AI-powered chatbots can provide instant quotes and answer customer queries, while ML algorithms can analyze vast amounts of data to identify risk factors and predict claim patterns.

- Blockchain Technology: Blockchain can enhance transparency and security in travel insurance transactions. It can be used to create immutable records of policy details, claims, and payments, reducing fraud and improving trust between insurers and customers.

- Mobile Apps and Digital Platforms: Mobile apps and digital platforms are becoming increasingly popular for purchasing travel insurance, managing policies, and filing claims. These platforms offer convenience, accessibility, and real-time information, making it easier for travelers to access insurance services.

Conclusion

In the ever-evolving world of travel, having the right insurance is no longer a luxury, it’s a necessity. Annual travel insurance plans offer a robust solution for frequent travelers, providing comprehensive coverage and peace of mind for every journey. By carefully considering your travel patterns, coverage needs, and budget, you can select an annual plan that empowers you to explore the world with confidence and assurance. Remember, the right insurance can turn unexpected events into manageable situations, allowing you to focus on what truly matters – enjoying your travels.